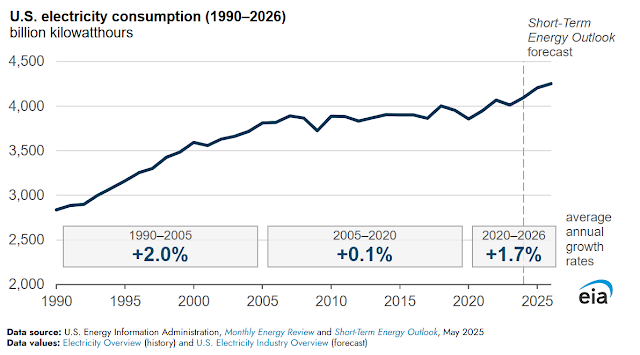

I recently posted about U.S. electricity prices by state and the reasons behind some of the differences. There are many more reasons why power prices change. I will show this with the cases of two states, Louisiana and Ohio. Only recently, since about 2023, has power consumption begun to rise after being more or less stagnant since around 2005, as shown below.

U.S. Residential Electricity Prices Keep Rising

The EIA recently reported that U.S. residential electricity prices have increased faster than inflation and are expected to continue to increase through 2026. Commodities like natural gas and crude oil have declined since the disruption due to the beginning of the Russia-Ukraine war in 2022. Electricity prices, however, have continued to rise since 2022, rising 13-18% since then. These prices have risen a little faster than post-COVID inflation, as the graph below shows.

Average annual expenditures

for U.S. consumers for electricity have been rising since 2020. U.S. consumer

average annual expenditures for gasoline are highest at nearly $2500, followed

by electricity at about $1750, and natural gas at about $500.

EIA notes that electricity

prices include the costs to generate, transmit, and distribute electricity and

that all of those costs need to be considered.

“Utility spending on electricity distribution has

surpassed spending on electricity transmission and production, according to our

analysis of utilities’ financial reports to the Federal Energy Regulatory

Commission. The generation-related portions of retail electricity typically lag

changes in wholesale spot prices of electricity generation fuels such as

natural gas and coal depending on the customer contract agreements.”

The graph below showing

regional variations in electricity prices is a good one and shows that areas

with already high electricity prices, like the Pacific, Middle Atlantic, and

New England regions, have also experienced the highest increases from 2022 to

2025. These regions are saddled with various issues like strong pushes for

renewables that necessitate more transmission upgrades, inadequate natural gas

pipeline infrastructure, and increasing power demand.

Louisiana Power Prices Set for Big Rise Due to IOU

Monopolies Charging Ratepayers: Customer-Centered Options are an Alternative,

According to Op Ed

A recent op ed in the Center

Square by Daniel J. Erspamer of the Pelican Institute for Public Policy notes

increasing power bills and energy demand in the state of Louisiana. However,

Louisiana currently has the fourth-lowest electricity costs among the 50

states. He notes that the biggest utility in the state “is seeking approval

to spend billions on new infrastructure projects to replace aging fleets and

meet escalating electricity needs.” He says investors, not ratepayers,

should finance those upgrade projects. He complains that these vertically

integrated monopoly investor-owned utilities, or IOUs, control both generation

and distribution. He cites recent analysis that suggests power prices could

rise by as much as 90% to 2030 from today’s rates. That could put Louisiana’s

2030 rates as high as Maine's or New York's rates are today. He writes that

there are other options, but he is a bit vague:

“Customer-Centered Options offer a smarter, more

sustainable alternative. These proposals could modernize the state’s energy

framework, expand consumer choice, and reduce the financial burden placed on

ratepayers. By evaluating proposals to allow large energy users to procure or

generate their own electricity – when doing so benefits the entire grid – the

LPSC {Louisiana Public Service Commission} may discover new solutions that

improve reliability and contain costs. This shift could not only speed up the

deployment of new energy technologies, but also alleviate pressure on

regulators and public utilities. It would empower consumers by aligning energy

development with real market needs rather than arbitrary regulatory constraints.”

“The benefits are clear: faster innovation, greater grid

resilience, expanded energy diversity and, ultimately, lower long-term costs

for households and businesses alike.”

The idea of large energy

users procuring and generating their own energy certainly suggests facilities

like data centers, but could also include industrial power consumers. These are

not bad ideas. One might ask why all ratepayers should be charged for upgrades

needed to provide energy for AI data centers and industrial power users. It is

a legitimate question. However, I am sure some of those needed upgrades are not

a result of these heavy power users.

Ohio Power Prices Rising Due to PJM’s Capacity Auction

Revealing Generation Shortfalls

While I sympathize with

Louisiana’s future power price concerns, here in Ohio, where I live, we pay the

18th highest power prices, and on June 1, those prices are

expected to rise by 10-15% for average consumers in the state. That might move

us to the 12th-highest costs. I am not looking forward to higher power

bills since they have already gone up in recent years, and I am currently

unemployed. However, I am a frugal power consumer since I have to be.

The reason for the current

rise in Ohio is the recent PJM capacity auction, where future capacity prices

skyrocketed. The main issue is inadequate power generation to meet future

demand. An article in the Toledo Regional Chamber of Commerce explains capacity

prices:

“Capacity costs are what you pay to make sure enough

electricity is available — especially during peak times like summer heat waves.”

The article also addresses the reasons that capacity prices rise:

They can be seen as power reliability costs. Again, large

power users like AI data centers and industrial users are a factor since they

use lots of power. PJM recently warned that power shortages could occur in Ohio

and West Virginia if conditions are extreme enough. They are concerned that the

lack of new generation and the retirement of other generation can lead to a

potential shortfall in a heatwave scenario. PJM noted that in such a scenario,

they would rely on “contracted demand response programs,” presumably

from large power consumers. Those customers are paid to reduce power

consumption during an emergency. AEP Ohio, my power provider, noted that the

PJM auction is why Ohio rates are set to rise on June 1.

“In a recent auction, the entire PJM region saw

significant increases in the price of electricity generation capacity compared

with previous auctions,” AEP Ohio stated. “This cost is always passed to

customers dollar-for-dollar, with no markup or profit for AEP Ohio.”

The Toledo Regional Chamber of Commerce article also notes that businesses will have higher power cost increases, up to 29%! That is quite an increase, and I would expect that those businesses, in turn, will raise product prices for consumers to help alleviate the costs. According to another article, these price increases are expected to last for 3-5 years, until more generation is built and turned online.

References:

U.S.

electricity prices continue steady increase. EIA. Today In Energy. May 14,

2025. U.S.

electricity prices continue steady increase - U.S. Energy Information

Administration (EIA)

Op-Ed:

Louisiana’s energy future depends on empowering consumers, not protecting

monopolies. Opinion by Daniel J. Erspamer | Pelican Institute for Public Policy.

The Center Square. May 14, 2025. Op-Ed:

Louisiana’s energy future depends on empowering consumers, not protecting

monopolies

Watt’s-Up:

Why Ohio’s Electricity Capacity Costs Are Rising June 1, 2025. Toledo Regional

Chamber of Commerce. May 13, 2025. Watt’s-Up:

Why Ohio’s Electricity Capacity Costs Are Rising June 1, 2025 - Toledo Regional

Chamber of Commerce | Toledo, OH

Ohio

Residents to Face 10-15% Increase in Electricity Bills Post PJM Auction from

June 2025. Sienna Brooks. Hoodline. Cleveland. February 10, 2025. Ohio

Residents to Face 10-15% Increase in Electricity Bills Post PJM

West

Virginia and Ohio’s power grid operator warns of potential power shortages this

summer. Kevin Accettulla. WTRF Wheeling. West

Virginia and Ohio’s power grid operator warns of potential power shortages this

summer

No comments:

Post a Comment