Onboard carbon capture and storage systems (OCCSSs) are an

emerging method of decarbonizing shipping. Hydrogen, methanol, and ammonia are

expected to compete for powering ships with reduced carbon footprints. DNV

explains onboard carbon capture:

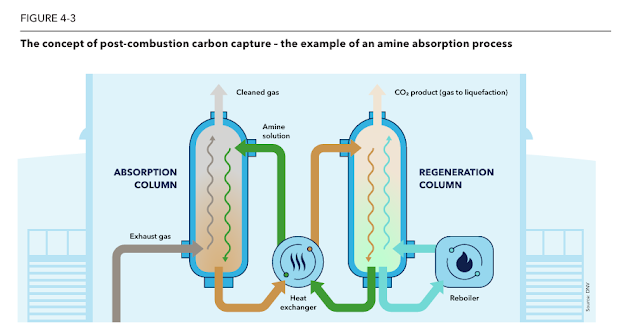

“Onboard carbon capture (OCC) covers a range of

technologies to capture carbon dioxide emissions from ships during operation.

For post-combustion systems, OCC involves cleaning of exhaust gases from CO2,

separating it, and storing it onboard for eventual offloading, in various

different forms depending on the technology (gas, liquid, or mineral). For

pre-combustion, carbon is separated from the fuel to produce hydrogen and use

it in dedicated energy conversion machinery.”

DNV has a great white paper

on OCCSSs. They note that ideally, an OCCSS should be incorporated into new

ship builds rather than retrofitted. This is because space on the ship must be

carefully organized, and its safety maximized. It is also more expensive to

retrofit. DNV, which has been working with OCC since 2009, notes:

“A scaling of the CCUS infrastructure network, across

geographies and nations, will establish the grounds for uptake of onboard

carbon capture technology. As of today, this infrastructure is not established.

The shipping industry needs to reach out to relevant CCUS development projects

near major shipping hubs to discuss how the maritime industry can connect to

the wider CCUS value chain.”

They also point out the

importance of after-treatment and compare it to the SOx scrubbers utilized

after the 2020 sulfur rules for ships went into effect.

“Shipping companies will aim to ensure compliance

through effective combinations of decarbonization options: carbon-neutral

fuels, energy-efficiency improvements, operations optimization, and onboard

carbon capture. Similar to what happened in the 2020s with the global sulphur

cap, the after-treatment of carbon emissions is expected to be relevant for

both existing ships and newbuilds.”

An important consideration is

that carbon capture systems use fuel to run them, and that fuel must be

accounted for in decarbonization accounting, cost analysis, and overall ship

energy systems. The availability of disposal systems for the captured CO2 is

another important consideration. Offshore wells are being outfitted for carbon

sequestration in many places, so that will likely be a main route for disposal.

DNV lists five steps of the

OCCSS value chain: 1) onboard capture, 2) onboard storage, 3) offloading, 4)

transportation, and 5) permanent storage or utilization.

Product specifications and

purity requirements must be met for offloading. Ports around the world must be

coordinated with CCUS projects around the world to minimize CO2 transport

costs. Different methods of carbon capture are summarized in the graphics

below.

They note that the capture

rate must be balanced against the fuel penalty.

“The fuel penalty depends on the type and performance of

the capture technology, as well as the ship’s operating profile and engine

load. The trade-off between high capture and low fuel penalty is one of the

main challenges of onboard carbon capture, as it affects both the environmental

and economic viability of the technology. Systems operating with a high capture

rate may have excessive energy demands, making them less feasible from an

operational and cost perspective.”

Cost analysis is very important for these projects. Ships that run on LNG can have some advantages in coordinating processes such as liquefaction and can implement smaller capture systems, saving energy and space. Cost must be balanced with decarbonization goals.

Regulations vary by

region and include GHG regs, safety regs, and waste handling regs. These are

summarized below.

Other practical

considerations are noted in the graphics below, including onboard positioning

and the different needs for different types of ships. The extra weight of the

CO2 and its capture and storage system is also a consideration.

Shanghai Qiyao Environmental Technology Conducts First

Ship-to-Ship Liquefied CO2 Transfer

Shanghai Qiyao Environmental

Technology (SMDERI-QET) recently conducted the world’s first ship-to-ship

liquid CO2 transfer at the Yangshan Deep-Water Port in Shanghai. Global Data

explains:

“This transfer demonstrates an end-to-end solution

comprising onboard carbon capture, liquefaction, storage, and offloading to

carbon utilisation facilities.”

“SMDERI-QET's Onboard Carbon Capture and Storage System

(OCCS) has achieved more than an 80% capture rate of carbon dioxide with a

99.9% purity level.”

“Since delivering the first full-process OCCS in early

2024, SMDERI-QET has completed several LCO₂ offloading projects, enabling ship

owners to improve their Carbon Intensity Indicator (CII) ratings.”

The company noted that the

lack of port infrastructure capable of managing large-scale carbon storage and

recovery has hindered their ability to offload more ship-to-shore LCO2. They

noted that:

“…transferring LCO₂ from ship to ship greatly enhances the

adaptability of operations, allowing for efficient loading and unloading for

ships at terminals that may lack the necessary facilities.”

They plan to collaborate with

domestic and international partners to help develop regulations and standards

for marine carbon capture and transportation.

SMDERI-QET's general manager,

Su Yi, noted:

“We are confident that the completion of the world’s

first ship-to-ship LCO₂ transfer, together with the further development of

onboard carbon capture technologies, will not only lead to rapid development of

a global network of shore-based carbon storage and utilisation facilities, but

accelerate the decarbonisation of shipping.”

References:

SMDERI-QET

successfully conducts world’s first ship-to-ship LCO₂ transfer. GlobalData.

June 27, 2025. SMDERI-QET

successfully conducts world’s first ship-to-ship LCO₂ transfer

Onboard

Carbon Capture and Storage on Ships. Chara Georgopoulou. DNV. Onboard

carbon capture and storage on ships

The Potential

of Onboard Carbon Capture in Shipping. DNV. White Paper. September 2024.

DNV_Onboard_Carbon_Capture_White_paper_24-09_web.pdf