Oil and gas can be found in small quantities in several distinct basins in Poland and its vicinity. The Permian Basin which covers parts of Poland, Germany, Denmark, the North Sea, the Baltic Sea, and the Netherlands is the country’s biggest oil-producing basin. That is also where a new oil discovery, touted as the biggest in 20 years, was recently found in the Lubuskie region of Western Poland, near the German border. The first chart below shows the oil and gas resources of Poland. The maps below show the basins, oil and gas fields, and the Zechstein Sea area as it appeared in the Upper Permian. The stratigraphic column shows the rocks in that sequence and the productive Rotleigand Sandstone sequence below.

+

Oil and gas

production began in Poland in 1853 with the Bobrka field which produced oil. The

first refinery was built in 1854. By 1900 Poland was the third most productive

region in the world. This was well before the world’s big oil fields were

discovered. The Permian Basin in Western Poland, the Baltic Sea, and small

older fields in the Carpathian Mountains in the south of the country were the

producing regions.

The B3 oil

field off the northern coast of Poland in the Baltic Sea was discovered in

1981, began producing in earnest in 1992, peaked in 2003, and was producing 1.9

million Bbls per annum in 2006, about 5200 Bbls/day. By 2022, production was

about 2000 Bbls/day, and today it is closer to 1100 Bbls/day. The field is produced from a Middle Cambrian-aged sandstone about 1000-1450 meters (about 3000-4000 ft)

deep. That sandstone is now considered to be a decent candidate for offshore CO2

sequestration.

The Barnówko-Mostno-Buszewo

onshore oil field in far Western Poland’s Permian Basin was discovered in 1993

and is one of the biggest in the country with reserves of 90 million barrels

and 350 BCF of gas. The Lubiatów-Międzychód-Grotów oil field was discovered in

1994 in the same region with reserves of 38 million Bbls of oil and 160BCF of

gas. These areas make up Poland’s biggest oil reserves. The natural gas fields

in Poland are generally small with reserves of 70-700 BCF. FX Energy was

drilling Western Poland in the mid-2010s, targeting the Rotliegend sandstone at

about 2460 meters (8070 ft).

The

intracontinental Southern Permian Basin is part of Europe’s largest sedimentary

basin, the Central European Basin, and is well-studied. The Zechstein Dolomite reservoirs,

the largest onshore oil reservoirs in Poland are heterogeneous and the carbonate

and evaporite sequences contain some source rocks of sufficient TOC.

The Upper Permian in Poland also hosts many evaporites and salt structures as shown below. These can enhance hydrocarbon trapping in some cases.

Poland Imports Most of Its Oil & Gas

Currently, Poland

imports up to 95% of the oil it consumes. Thus, finding domestic oil is very

significant. Poland has worked hard to wean itself off of Russian oil and gas. Poland

consumes about 580,000 barrels of oil daily, of which it imports approximately

540,000 barrels. In 2023 about 45% of Poland’s oil was imported from Saudi

Arabia. For a country very dependent on imports, even small oil finds are significant.

Russia was of course opposed to the development of Polish shale gas when it was

being pursued since it would compete with Russian gas. Poland’s electricity

grid is powered mainly by carbon-intensive, air pollution-intensive lignite

coal. A bigger domestic natural gas industry could alleviate that pollution and

CO2 emissions by burning natural gas instead. However, at low production rates

it would require lots of wells and increase land use, landowner, and

environmental issues as well.

New Oil Discovery in Lubuskie Region in Western Poland’s

Permian Basin is Significant

The discovery was

made by Orlen, a very large integrated company that bought Polish national gas

company PGNiG in 2020. The new discovery is in the onshore Permian Basin region

in far Western Poland at a depth of 2750 meters (about 9000 feet). Based on the

depth, I am guessing that the production is from the Rotliegand Sandstone based on the depth but it could be from the Zechstein which produces the most oil. The Zechstein

Dolomite above the Rotleigand is the biggest producer in the region. The Zechstein Limestone

just below the Dolomite is also a big producer as is the Rotliegand Sandstone

below.

The newly discovered

field is expected to yield about 16,500 tonnes annually (about 120,000 Bbls or

just 330 Bbls per day) with a total of about 100,000 tonnes (730,000 Bbls) but

Orlen thinks that similar geologic structures in the area could make the total

yield about 500,000 tonnes, or 3.65 million barrels.

The following graphics and maps are from The Orlen Group's 2023 Integrated Report.

Revisiting Polish Shale Gas (Currently Not on the

Table): The Llandovery–Wenlock Silurian Shale Belt in the Baltic, Podlasie, and

Lublin Basins: Current Incentives, Challenges, and Opportunities

Clearly,

Poland could benefit by developing some of their shale gas resources. Replacing

Russian gas and reducing the need to import LNG is one incentive. The high

price of natural gas in Europe and the likelihood it will continue in the years

ahead is another incentive. Early tests of Polish shale gas resources around

2012-2014 were conducted at a time when public opposition was high and natural

gas prices were low. Reserves and some parameters of the shale were not as

suitable as hoped but exploitable reserves are still there and may be able to

be tapped profitably at favorable market conditions.

Back in 2012

Poland was gearing up for new shale gas drilling. I remember attending the AAPG

U.S. national conference in Pittsburgh in 2013 and talking with a poster presenter

there from the Polish Geological Survey equivalent and discussing shale hopes.

In 2012 111 concessions for exploratory drilling were issued. The Polish

national gas company PGNiG was involved as a beneficiary alongside foreign companies.

By mid-2013 ConocoPhillips was producing shale gas in Poland and things looked

hopeful. ConocoPhillips invested $220 million in Poland and ended up drilling 7

wells in the Baltic Basin. However, by mid-2015 they pulled out of Poland and by

mid-2017 most companies were leaving due to unsatisfactory well results. There

were only 20 concessions left, and exploration had ceased. Previously, Chevron,

ExxonMobil, Total, and Marathon Oil had pulled out. Shale gas exploration wells

were drilled in Poland between 2010 and 2016, after which the major companies

pulled out of the country due to poor well results. No commercial production

was established, despite high hopes. Thus far, there are 72 bore holes

penetrating the shales. It is unclear how many of those are horizontal wells. Beyond

the necessity of favorable geology, the keys to successfully producing shale

gas in Poland are high enough gas prices, the cost and environmental/climate benefits

of producing domestically vs. imported LNG, low drilling, completion, and

infrastructure costs, technology improvements that improve economics, and the

ability to find the most productive areas. Many think that 72 boreholes are

inadequate for a complete assessment of the three basins. However, at this

point producing Polish shale gas should probably be considered a ’longshot’.

The need for domestic

oil and gas in a country dependent on imports makes it more valuable at lower

finding and development costs since imported oil and gas is more expensive.

That could make shale gas in Poland viable at some point if better results were

to be obtained.

The Energy

Information Administration estimated in 2013 that 146 trillion cubic feet (TCF)

of shale gas and 1.8 billion barrels (BBbls) to be tapped in Poland. However,

after poor results due to low permeability of the rocks and several areas with

complex faulting, the Polish Geological Institute predicted just 24.8 TCF in shale

gas reserves. That is still a lot of gas for a country dependent on imports, but

investment never returned to explore more for shale gas and tight oil. The maps and graphics below are from a 2013 paper.

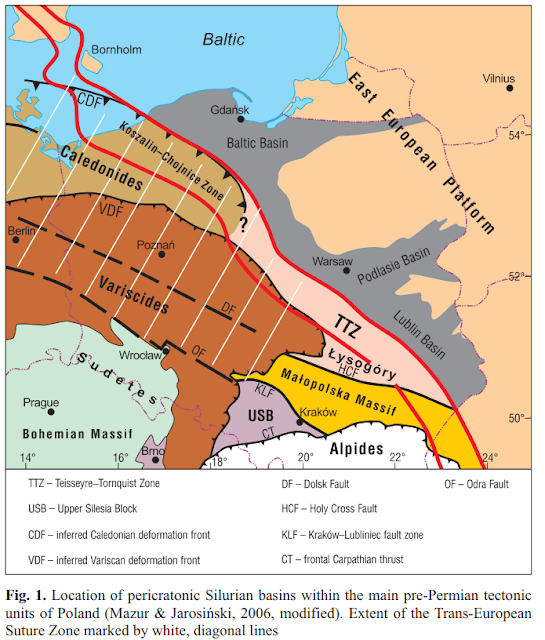

Map of

Geological Structures and Silurian Sedimentary Basins in Poland with Thick

Organic Shale Sequences. Source: Silurian shales of the East European Platform

in Poland – some exploration problems. Szczepan J. Porêbski, Wiesaw Prugar,

Jarosaw Zacharski. Przegl¹d Geologiczny, vol. 61, no. 11/1, 2013. 28138-43318-1-SM.pdf

A 2020 paper explored

the petrophysical characteristics of shales in Poland and noted that “two

formations in the Baltic Basin: Ordovician Sasino Formation (Sa Fm) and Jantar Member

(Ja Mb) of the Silurian Pasłęk Formation as potential resources of

unconventional hydrocarbons. The discussed formations are composed of

black, dark gray, and gray greenish

bituminous shales. Average TOC values of Sa Fm and Ja Mb are 3.1 and 3.0 wt.%, respectively.

Depth of occurrence is between 2800-3200m.” The study was based on well log

analysis and concluded that there was great heterogeneity in the mudstones

(shales) being pursued.

A 2021 study

considered the possibility of Polish shale gas development and modeled it after

the Barnett Shale in Texas. The study noted the average total organic content

(TOC) of 3–12% with the highest TOC occurring in Upper Ordovician shales in

central-western parts of the Baltic Basin. However, that is the area that ConocoPhillips

ended up abandoning due to unsatisfactory production results. The study modeled and forecasted gas shale gas production potential as shown below.

An August 2017

study published by Intech presented a detailed geological and petrophysical analysis

of shale gas potential in Poland, particularly in the Baltic Basin. Some graphics

from the paper are shown below. The paper concluded:

"Presented results show that Polish shale formations of

the Silurian and Ordovician age are different as regards mineral composition,

reservoir properties and elastic parameters. In each formation internal

heterogeneity was found. Diversity was also observed within the same formations

in different wells. Two selected formations were recognized as potential sweet

spots, i.e. Ja Mb and Sa Fm. They are relatively rich in organic matter.

Results of the analyses indicate distinctly visible differences between them

and surrounding formations (Pe Fm, Pa Fm and Pr Fm).”

“Research based on the laboratory results, well logs and the outcomes of the comprehensive interpretation of well logging confirmed great diversification of formations in the study but also revealed some regularities.”

References:

EU Country Announces Largest Oil Field Discovery in 20 Years.

Kathrine Frich. Dagens News (US). September 15, 2024. EU Country Announces Largest Oil Field Discovery in 20 Years

(msn.com)

A "large" oil field

discovered in an EU country: "The largest crude oil find in 20 years".

El Economista. September 2024. A "large" oil field discovered in an EU country:

"The largest crude oil find in 20 years" (eleconomista.es)

Silurian shales of the East European

Platform in Poland – some exploration problems. Szczepan J. Porêbski, Wiesaw

Prugar, Jarosaw Zacharski. Przegl¹d Geologiczny, vol. 61, no. 11/1, 2013. 28138-43318-1-SM.pdf

Is

Polish shale gas the answer to EU energy shortage? Jo Harper. DW. MSN News.

April 3, 2023. Is Polish shale gas the answer to EU energy

shortage? (msn.com)

Polish

shale hitting the rocks. Jo Harper. DW. May 24, 2016. Polish shale hitting the rocks – DW –

05/24/2016

What

happened to Polish shale gas? Olivier Bault. March 29, 2018. Visegrad Post.

What happened to Polish shale gas? |

Visegrád Post (visegradpost.com)

Petrophysical

Investigations of Shale Gas Formations in Poland. Jarzyna J A,

Krakowska-Madejska P I, Puskarczyk E and Wawrzyniak-Guz K. AGH University of

Science and Technology, Faculty of Geology Geophysics and Environmental Protection,

Department of Geophysics, Poland. Crimson Publishers. Augut 12, 2020. Aspects

Min Miner Sci. 5(3). AMMS. 000611. 2020. DOI: 10.31031/AMMS.2020.05.000611. Petrophysical_Investigations_of_Shale_Gas_Formatio.pdf

How

Many Wells? Exploring the Scope of Shale Gas Production for Achieving Gas

Self-Sufficiency in Poland. Henrik Wachtmeister, Magdalena Kuchler & Mikael

Höök. Natural Resources Research volume 30, pages2483–2496 (2021). April 5,

2021. How Many Wells? Exploring the Scope

of Shale Gas Production for Achieving Gas Self-Sufficiency in Poland |

SpringerLink

Shale

Gas in Poland. Jadwiga A. Jarzyna, Maria Bała, Paulina I. Krakowska, Edyta

Puskarczyk, Anna Strzępowicz, Kamila Wawrzyniak-Guz, Dariusz Więcław and Jerzy

Ziętek. Chapter 9 in Advances in Natural

Gas Emerging Technologies. August 2017. Shale_Gas_in_Poland.pdf

Is The

Polish Shale Gas Industry Set For A Comeback? Gefira. OilPrice.com. Jul 01,

2017. Is The Polish Shale Gas Industry Set

For A Comeback? | OilPrice.com

FX

Energy begins drilling Karmin well in Poland. World Pipelines. July 30, 2014. FX

Energy begins drilling Karmin shale gas well in Poland | World Pipelines

Possibilities

of energy storage in geological structures in Poland. July 2022 Conference:

Mathematical methods and terminology in geology 2022. Marek Leszek Solecki. Pawel

Wojnarowski. Gordon Wasilewski, and Grzegorz Machowski. (PDF)

Possibilities of energy storage in geological structures in Poland

(researchgate.net)

Zechstein

Main Dolomite oil characteristics in the Southern Permian Basin: I. Polish and

German sectors. Mirosław Słowakiewicz, Martin Blumenberg, Dariusz Więcław, Heinz-Gerd

Röhling, Georg Scheeder, Katja Hindenberg, Andrzej Leśniak, Erdem F. Idiz, Maurice

E. Tucker, Richard D. Pancost, Maciej J. Kotarba, and Johannes P. Gerling. Marine

and Petroleum Geology. Volume 93, May 2018, Pages 356-375. Zechstein

Main Dolomite oil characteristics in the Southern Permian Basin: I. Polish and

German sectors - ScienceDirect

Zeichstein.

Wikipedia. Zechstein -

Wikipedia

Rotliegend.

Wikipedia. Rotliegend -

Wikipedia

Oil

industry in Poland. Wikipedia. Oil industry in

Poland - Wikipedia

B3 oil

field. Wikipedia. B3 oil

field - Wikipedia

ORLEN

Group. Integrated Report 2023. report-2023-en.pdf

No comments:

Post a Comment