There are three basic types of underground natural gas storage: 1) storage in depleted gas or oil reservoirs, 2) storage in aquifers, and 3) storage in salt caverns. Less used are mines and hard rock caverns. Compressed gas is pumped in to increase reservoir pressure. Subsurface requirements include a reservoir rock with adequate porosity and permeability, a trapping mechanism to capture the hydrocarbons, a seal or confining layer that keeps fluids from leaking out, and adequate pressure to flow.

The rate at

which natural gas can be withdrawn from a reservoir is known as its

deliverability. I worked at an early horizontal well in 1996 that was designed

to increase deliverability by accessing more sections of the reservoir in a depleted

gas field. I also worked at wells that drilled through existing underground gas

storage fields to access deeper oil & gas reservoirs. The filled reservoirs

that were previously hydraulically fractured showed high gas readings during

drilling and were flared temporarily for safety before being cased off. Most

gas storage production wells are vertical wells but horizontal wells are

becoming more common and can increase field deliverability.

Most U.S.

underground gas storage is in depleted oil and gas reservoirs. Most storage

fields are near highly populated gas consumption areas. Existing wells,

gathering systems, and pipeline connections are utilized for storage fields.

This can be problematic when the wells and pipelines are old and can have

issues like well casing breaches or pipeline leaks. These depleted fields are

often well-mapped during the development phase and already have cushion gas

present in the reservoir.

Aquifer

storage is common in the Midwest, particularly in Illinois, Indiana, and Iowa. These

fields require more base, or cushion gas, and have less flexibility in injecting

and withdrawing compared to depleted oil & gas fields. However, a strong

water drive component in the aquifer can enhance deliverability. A water drive

means that the water exerts pressure in the gas part of the reservoir which

drives deliverability.

Salt cavern fields are common in Louisiana, Texas, and Mississippi along the Gulf Coast. They have low base gas requirements and high deliverability rates. There are also a few salt cavern fields in Michigan, Pennsylvania, Ohio, West Virginia, and New York where the salt beds are leached out to make open caverns. Usually, the salts are solution-mined by being dissolved in water and producing the resulting brine to leave a cavern. This is more expensive than storage in depleted oil and gas fields but as noted also offers higher deliverability rates.

Interstate

pipeline companies, intrastate pipeline companies, local distribution companies

(LDCs), and independent storage service providers are commonly the owners of

natural gas storage fields. There are about 400 active underground gas storage

facilities in 30 U.S. states owned by about 120 different companies. The gas in

the storage fields may be held under lease with shippers, LDCs, or end users

who own the gas. According to the EIA, the base gas is also used to ensure supply

management:

“…interstate pipeline companies rely heavily on

underground storage to facilitate load balancing and system supply management

on their long-haul transmission lines. FERC regulations allow interstate

pipeline companies to reserve some portion of their storage capacity for this

purpose. Nonetheless, the bulk of their storage capacity is leased to other

industry participants. Intrastate pipeline companies also use storage capacity

and inventories for similar purposes, in addition to serving customers.”

LDCs often lease a part of their storage capacity to third

parties, often gas marketers. This allows them to earn extra revenue. Natural

gas storage was deregulated in 1994, allowing for such sharing of resources. This

FERC Order 636 ushered in ‘open access’ to gas storage. EIA explains:

“Open access has allowed storage to be used other than

simply as backup inventory or as a supplemental seasonal supply source. For

example, marketers and other third parties may move natural gas into and out of

storage (subject to the operational capabilities of the site or the tariff

limitations) as changes in price levels present opportunities to buy and store

natural gas when demand is relatively low, and sell during periods of

peak-demand when the price is elevated. Further, storage is used in conjunction

with various financial instruments (e.g., futures and options contracts, swaps,

etc.) in creative and complex ways in an attempt to profit from market

conditions.”

Open access favors salt cavern storage due to its high

deliverability. Independent storage providers have focused on developing

high-deliverability storage fields, both salt caverns and depleted oil &

gas fields.

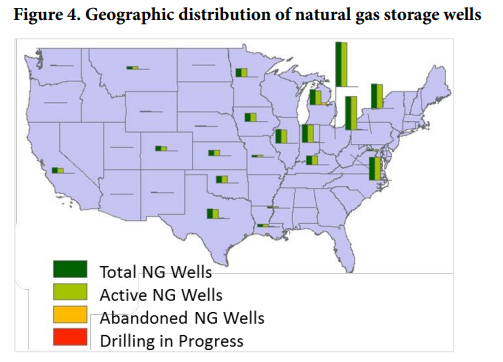

Many of the

wells in gas storage fields were not originally designed to inject or produce

from gas storage fields. Factors like the age of the well and the composition

of the hydrocarbons and brine previously produced from it are important

considerations. They can affect the mechanical integrity of the wells. As can

be seen below, my state, Ohio, has by far the most gas storage wells followed

by Pennsylvania.

Base Gas (or Cushion Gas) vs. Working Gas

Volumetrics for gas storage include total gas

capacity, or how much gas the field can hold and gas in storage, which is the

gas stored at any particular time. Base gas, also known as cushion gas, “is

the volume of natural gas intended as permanent inventory in a storage

reservoir to maintain adequate pressure and deliverability rates throughout the

withdrawal season.” The working gas is the total gas capacity minus the base

gas. It represents the gas that is available to be consumed.

Deliverability and Injection Capacity

Deliverability

is another important metric. It refers to the rate at which gas can be withdrawn.

It is usually expressed as the amount of gas that can be delivered in one 24-hour

period. It is usually given in MMCF/day. According to the EIA deliverability “depends

on factors such as the amount of natural gas in the reservoir at any particular

time, the pressure within the reservoir, the compression capability available

to the reservoir, the configuration and capabilities of surface facilities

associated with the reservoir, and other factors.”

Injection

capacity refers to how much gas can be injected in a 24-hour period. Like its complement,

deliverability, it is dependent on how much gas is in the reservoir at any

given time.

EIA Gas Storage Reporting

The EIA tracks

working gas in underground storage and compares it to the 5-year maximum, the 5-year

minimum, and the 5-year average. This is reported weekly. The latest report is

shown below for the week ending August 16, 2024.

Natural Gas Storage Regulation in the U.S.

Regulation of natural

gas pipelines moving gas in and out of gas storage facilities falls under

Federal jurisdiction under the Natural Gas Pipeline Safety Act (NGPSA). The

Pipeline Hazardous Materials Safety Administration (PHMSA) regulates natural

gas storage along with states. After the Aliso Canyon incident, the PHMSA became

more involved with storage field regulation. Facilities are classified as

interstate or intrastate and are regulated differently. Interstate facilities

that link multiple states are regulated under FERC. Intrastate facilities,

entirely within one state, are regulated by rules drawn up by state public

utility commissions and state oil and gas boards.

Sometimes

jurisdiction becomes an issue. This happens when FERC or PHMSA requirements

collide with state requirements. In 2011 a task force was convened as PHMSA attempted

to codify new rules. This task force included the Interstate Natural Gas

Association of America (INGAA), the American Gas Association (AGA), PHMSA, state

agencies, and input from The American Petroleum Institute (API). They put out

recommendations in 2015 for salt cavern storage and depleted reservoir storage.

The PIPES Act provides that the State authorities may adopt additional or more

stringent safety regulations for intrastate gas storage facilities as long as

they are compatible with the Federal minimum standards. Since 90% of storage

fields are considered to be intrastate, or within the bounds of a single state,

then state requirements were reviewed to see if they met or exceeded federal

requirements.

Ensuring Gas Storage Safety and Reliability and the

Aliso Canyon Catastrophic Leak

In October

2016 the Department of Energy released a report: Ensuring Safe and Reliable

Underground Natural Gas Storage: Final Report of the Interagency Task Force on

Natural Gas Storage Safety. This report was prompted by the powerful 2015 Aliso

Canyon gas storage field leak that resulted in many people being evacuated for long

periods of time as the damaged well was addressed. A federal task force involving

Congress, the DOE, and the DOT’s Pipeline and Hazardous Materials Safety Administration

(PHMSA) was convened to address the issue following Obama’s signing of the Protecting

our Infrastructure of Pipelines and Enhancing Safety (PIPES) Act of 2016. The

key recommendations from the task force report are as follows:

• Gas storage operators should begin a rigorous

evaluation program to baseline the status of their wells, establish risk

management planning and, in most cases, phase-out old wells with

single-point-of failure designs.

• Advance preparation for possible natural gas leaks

and coordinated emergency response in the case of a leak can help manage and

mitigate potential health and environmental impacts of leaks when they do

occur.

• Power system planners and operators need to better

understand the risks that potential gas storage disruptions create for the

electric system

The source of

the Aliso Canyon leak was a very old well, drilled in the 1950s, that had

developed casing leaks. According to discussions I had at the time with a geologist

who worked in Appalachian gas storage, this old well should not have been used

in a gas storage field. Production wells in storage fields need high

deliverability through reservoir properties, pressure, and adequate well

construction and maintenance. This was not the case with the very old and

inadequate well that resulted in the catastrophic Aliso Canyon leak in

California. Below is a graph from the report showing the age of wells in gas

storage fields. This is concerning since most of the wells were drilled in the

1950s, 60s, and 70s. About 80% of these wells were drilled before 1980.

The Aliso

Canyon gas storage field is owned by Southern California Gas Company

(SoCalGas). The well leaked for four months. The primary public health concern was

the concentration of odorant in the ambient air. Odorants are added to natural

gas so they can be smelled when there is a leak. Odorant concentration is not

typically a concern during smaller leaks unless in confined spaces. Natural gas

may also contain hydrogen sulfide (H2S), other sulfur compounds, and benzene,

all potentially dangerous to human health. The leak initially released

approximately 53 metric tons of methane per hour or a total of approximately 1,300

metric tons of methane per day

What happened

at Aliso Canyon is known as a well integrity issue. Eight attempts to ‘top kill’

the well over the first two months of the leak were unsuccessful. The well was

eventually ‘bottom killed’ by drilling a relief well to intersect the wellbore

and divert the flow. The old well could then be cemented and plugged. Drilling

of the old well began in 1953 and was completed in 1954. Thus, the well was

about 61 years old when the leak occurred. A schematic of the well is shown below

depicting what is believed to have happened when attempts to kill the well from

the surface (top kill) failed. The accident required detailed air monitoring

for methane, VOCs, benzene, and sulfur compounds. Only one sample showed unacceptable

levels of one dangerous chemical, H2S. The vast majority showed levels of these

compounds within acceptable limits. The PHMSA issued new requirements for

storage fields. The task force report goes on to estimate the impacts of the

leak on local residents and on California natural gas prices. Then they do some

scenario analysis, noting where leaking storage fields could cause the most damage

and disruption.

Task Force Recommendations

The task force made the following recommendations regarding well integrity:

1)

Operators should phase out wells with single

point of failure designs. This refers to having just one string of casing or

tubing shielding the wellbore from the surrounding rock. This was the case with

the Aliso Canyon well where gas was moved through both the tuing and the casing

outside the tubing.

2)

Operators should undertake rigorous well

integrity evaluation programs. This is what the PHMSA recommended. They

made specific recommendations for this:

“(1) a compilation and standardization of all available well records relevant to mechanical integrity; (2) an integrity testing program that includes usage of leakage surveys and cement bond and corrosion logs to establish that all wells are currently performing as expected; (3) documentation of a risk management plan to guide future monitoring, maintenance, and upgrades; (4) establishment of design standards for new well casing and tubing; and (5) establishment of safe operating pressures for existing casing and tubing. Many operators already apply these risk management practices in their operations. These approaches should be applied industry-wide.”

3)

Operators should prioritize integrity tests

that provide hard data on well performance. This involves monitoring,

logging, and mechanical integrity testing.

4)

Operators should deploy continuous monitoring

for wells and critical gas handling infrastructure.

The task force

also recommended risk management planning and better management of well record.

They also recommended some industry knowledge-gathering steps including DOE/DOT

joint studies on downhole safety valves and casing-wall thickness assessment

tools. They also noted that gaps in available data should be addressed. Many

other recommendations addressed what should be done when a leak occurs, including

air monitoring and other public protection measures. The report also addresses

reliability concerns such as supplying gas when storage levels are low and

keeping prices from spiking. Some gas storage facilities can affect electricity

reliability if they go offline due to a leak. The Aliso Canyon accident caused gas

price spikes in California some electricity price spikes as well.

How Stored Natural Gas is Valuated and Priced

A blog post in

Edison Energy notes several different ways storage gas may be valued: 1) intrinsic

value – the difference between injected cost and withdrawal cost, minus

cost to store. This is inherent in the common “forward market” where gas is

typically bought in summer when it is cheap to store and sold in winter when it

tends to cost more, 2) extrinsic value – a complex evaluation where in

one case gas is valued according to its ability to be sold quickly into a

profitable market that may appear quickly. Salt cavern storage, with its high

deliverability and injectability, is ideal for adding extrinsic value, 3) market

conditions – more specifically this refers to regional market conditions.

In the case of New England and the Northeast the regional market conditions are

strongly affected by the inadequate pipeline capacity. Market perceptions of

the ability to meet winter weather demand is a big factor, 4) storage

service level (firm vs. interruptible) – firm storage is guaranteed

to be available during peak demand and so is valued higher than interruptible

storage which has no such guarantee, 5) market access – delivering

storage to a volatile market subject to demand spikes and subsequent price

spikes due mainly to weather events has a higher extrinsic value. Inadequate

pipeline capacity, or another deliverability problem like the unwinterized gas

system in Texas in Feb. 2021, is often the real culprit of the price spikes,

and 6) storage space vs injection/withdrawal rights – some gas storage

facilities may have access limitations for a given day so that a given storage

space may be more or less valuable depending on those limitations.

The author of

the blog summarized the valuation of gas in storage as follows:

“In today’s complex energy environment, the ability to

quantify the value and take advantage of assets like storage is a combination

of known and unknown factors that depends on how one intends to use the asset

and the flexibility storage can provide to an entity trying to avoid risk. Each variable that goes into calculating the

potential benefit of storage comes with risk and reward and varies greatly

based on known market conditions at the time, as well as unpredictable market

conditions down the road being overlaid with the term commitment of owning

storage.”

References:

The

Basics of Underground Natural Gas Storage. Energy Information Administration. November

16, 2015. The Basics of Underground Natural Gas

Storage - U.S. Energy Information Administration (eia.gov)

Fact

Sheet: Ensuring Safe and Reliable Underground Natural Gas Storage. Department

of Energy. Fact

Sheet: Ensuring Safe and Reliable Underground Natural Gas Storage | Department

of Energy

Ensuring

Safe and Reliable Underground Natural Gas Storage. Final Report of the

Interagency Task Force on Natural Gas Storage Safety. Department of Energy.

October 2016. Ensuring

Safe and Reliable Underground Natural Gas Storage (energy.gov)

Weekly

Natural Gas Storage Report. for week ending August 16, 2024. Released: August

22, 2024. Energy Information Administration. Weekly Natural Gas Storage Report - EIA

How is Natural Gas Storage Valued? Jeff

Bolyard. Edison Energy. July 11, 2019. How

is Natural Gas Storage Valued? | Edison Energy

No comments:

Post a Comment