Reserves evaluation

is a predictive process based on the data available. With this post, I wanted to

both better understand and apply reserves analysis and compare the differences

between evaluating reserves of oil vs. gas vs. coal vs. minerals. I guess it's

kind of an exercise in comparisons of extracting gases, liquids, and solids in

various combinations and under varying conditions. Each phase has its own

physical laws to follow. Reserves usually refer to remaining reserves unless

they are presented as original reserves. In the U.S. the U.S. Geological Survey

is staked with assessing oil & gas, coal, and mineral resources and reserves.

Resources usually refer to original resource-in-place but may also refer to remaining

resource-in-place. Reserves refer to recoverable resources. This is discussed later

in this post.

Oil & Gas Reserves Evaluation

Oil and gas

reserves may be evaluated in a number of ways. They are also often dependent on

factors like geology, which can vary considerably, and can define the extent

of accumulations, and thus total reserves. Reservoir qualities like porosity,

permeability, pressure, natural and/or induced fractures, and intra-reservoir

barriers can affect reserves evaluation. The main and most accurate means of

predicting reserves is the evaluation of the production of individual wells. This

is done through decline curve analysis.

Decline Curve Analysis

What is decline

curve analysis? According to Wikipedia:

“Decline curve analysis is a means of predicting future

oil well or gas well production based on past production history. Production

decline curve analysis is a traditional means of identifying well production

problems and predicting well performance and life based on measured oil well

production.”

Decline curve analysis can also be used to geospatially map

production trends perhaps as estimated ultimate recovery (EUR) or 1st month production or maybe 1st year production. Oil and gas wells

typically produce their maximum output rate shortly after production begins,

usually in the first year. This early high production rate is known as ‘flush

production,’ initial production, or peak flow rate. Production decline is plotted logarithmically.

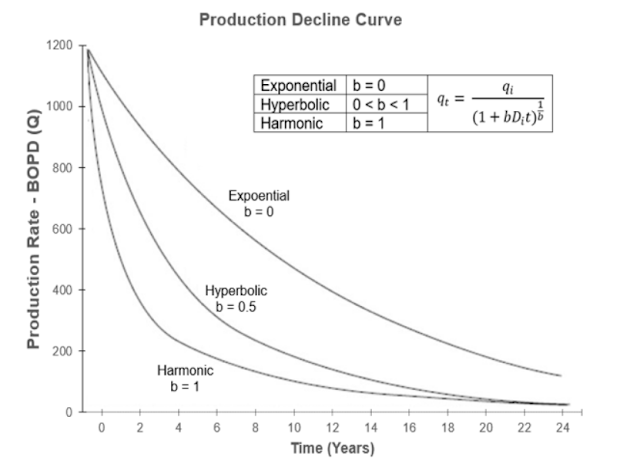

After flush production, well production usually levels out and curves may be

forecasted out to 30 years or more. There are different types of curves used to

draw out the later stabilized and relatively flat production rate. The three main

ones are exponential decline, hyperbolic decline, and harmonic decline, as shown

below. It should be pointed out, as the 2nd graph shows, that

initial or flush production is mainly not the concern of decline curves. The

main concern is to predict future production. The initial production is likely

to exhibit hyperbolic decline and the later production is likely to exhibit exponential

decline. Thus, as the 2nd graph shows, the two are often combined in

a curve.

Working as a geologist I found decline curve analysis to be a useful tool and I used it a lot. It enabled better production mapping which is tied into various kinds of geological mapping to arrive at a better understanding of field size and extents and possible geological issues affecting productivity. Decline curve analysis can also be used to discover possible mechanical issues with wells, especially if production drops significantly lower than curves suggest it should. For my purposes I used Excel’s simple logarithmic plots, but more accuracy can be attained with decline curve analysis software. This software is required for determining company-level reserves. A company’s reserves can affect its valuation, its ability to borrow money, and its ability to find development partners. The 1st graph below shows some of the common features of a decline curve. The 2nd graph is an example decline curve from a well.

PetroWiki states the ‘Golden rule of decline curve analysis

(DCA)’

“The basic assumption in this procedure is that whatever

causes controlled the trend of a curve in the past will continue to govern its

trend in the future in a uniform manner.”

Core Areas Delineation

Oil and gas

resources and reserves are often differentiated by in-place estimates and

recoverability estimates. These are often highest in the richest parts of the deposits

and sometimes in the areas where recoverability is highest. This is the case with shale reserves which are often continuous over a large area. The richest parts are often

called ‘core areas’ and are the most desired areas to drill due to those areas

having the highest profitability. Economics dictates in most cases that these will

be the areas drilled first.

Coal Reserves Evaluation

Unlike oil &

gas which are fluids, coal and mineral ores are solid (mineral brines are an

exception). Fluids flow. Solids do not flow. That means coal and mineral ores

are not amenable to evaluation through rate of production. Reserves are measured

differently. Coal evaluation involves an estimation of its energy value, or fuel

content. This is dependent on the chemical composition of the coal, specifically

the carbon, hydrogen, oxygen, nitrogen, and sulfur contents. An approximation

can be estimated by calculating a coal seam’s moisture, volatile matter, ash,

and fixed carbon contents. An ultimate, or elemental analysis is estimated with

the atomic elements listed above. The basic formula for determining the energy

value of coal from Wikipedia is gieven below.

The calorific value Q of coal [kJ/kg] is the heat

liberated by its complete combustion with oxygen. Q is a complex function of

the elemental composition of the coal[citation needed]. Q can be determined

experimentally using calorimeters. Dulong suggests the following approximate

formula for Q when the oxygen content is less than 10%:

Q = 337C + 1442(H - O/8) + 93S,

where C is the mass percent of carbon, H is the mass

percent of hydrogen, O is the mass percent of oxygen, and S is the mass percent

of sulfur in the coal. With these constants, Q is given in kilojoules per

kilogram.

The other main

factor in coal reserves evaluation is the size/geographic extent/total volume

of the coal seam. Changes in chemical composition in different geographical areas

and stratigraphic sections of the seam that affect energy value must also be

considered.

Coal energy

content is also measured in terms of its gross calorific value (GCV), or higher

heating value (HHV). This is used by facilities that combust coal to determine parameters

such as boiler efficiency, combustion values, and production costs.

Estimated global coal reserves by country are shown below. As can be seen, the U.S. is blessed with the highest coal reserves by a pretty good margin.

In the U.S. the

USGS assesses coal resources and reserves. Their methodology is summarized

below.

Phase I: Data collection

1. geologic–drill holes, measured sections, geophysical

data – that show coal bed thicknesses, partings, interburden/overburden

lithologies, or structure.

2. restrictions–mostly environmental and land-use restrictions.

3. societal-boundaries, property ownership, and mineral

ownership.

4. coal quality–data points that provide information on

coal quality parameters. (energy content)

5. coal economics–market prices and production costs/

Phase II: Data modeling

1. correlation– estimating bed sizes and lateral continuity

of individual beds

2. geologic models–using available geologic data to determine

if coals are produceable, both technically and economically.

3. GIS models-use GIS to map out restrictions and other

barriers to production.

4. Composite model–combine geologic and GIS models to

produce a composite model of the geology, restrictions, and societal features.

Phase III: Calculating resources and reserves

1. resources calculations-use composite model to: a.

calculate original resources b. calculate recoverable resources (for all

significant coal beds)

2. projected mine costs-estimate cost to produce.

3. cost curve graphs-combine estimated costs with market

price data to generate the graphs.

4. reserves determination-interpreted from the cost curve

graphs for all significant coal beds.

Mineral Reserves Evaluation

Similar to gas,

oil, and coal, mineral resources estimation is done through statistical means. Typically,

there is geological modeling of ore bodies, then they can be quantified with

statistical methods like block modeling. Block modeling utilizes common

statistical algorithms such as nearest neighbor, inverse distance weighting,

and kriging. These algorithms are also used in contour mapping.

“The

location, quantity, grade, geological characteristics and continuity of a

mineral resource are known, estimated or interpreted from specific geological

evidence and knowledge.”

Mineral

resources can be differentiated into three classes: 1) inferred mineral resources,

2) indicated mineral resources, and 3) measured mineral resources. Inferred mineral

resources are based on geological evidence but limited sampling. Sources of the

sampled data may be from outcrops, trenches, pits, workings and drill holes. Grade

or quality is estimated. It is assumed but not verified. Indicated mineral resources

are that part of a mineral resources where “quantity, grade or quality,

densities, shape and physical characteristics, can be estimated with a level of

confidence sufficient to allow the appropriate application of technical and

economic parameters, to support mine planning and evaluation of the economic

viability of the deposit.” The data is from the same sources as for inferred

mineral resources but is more extensive and reliable. Measured mineral

resources are those that whose parameters “are so well established that they

can be estimated with confidence.”

Mineral

reserves are classified as Probable Mineral Reserves – the economically

mineable parts of the indicated and measured reserves and the processing involved

to get them to market, and Proven Mineral Reserves – the economically mineable

parts of measured mineral resources based on feasibility studies.

Mineral Concentration is an Important Economic Factor

Minerals are

often contained within ores, which rocks as groups of minerals and mixes of

different types and at different concentrations. Thus, it is the ratios of desired

mineral to total ore by weight or volume that is the determining factor in mineral

resource and reserves estimation. Ore grade is often determined by desired

mineral concentration(s) in the ore. Another factor in determining economic

recoverability is the potential of co-production of multiple minerals. These

additions to the overall economic benefit of the ore can bring a marginally

profitable mineral over the threshold to profitability.

Just as oil and gas deposits have core areas and the low hanging fruit of large accumulations found and developed, so too do mineral assemblages. The core areas become those deposits with the highest mineral concentrations so that as time goes on more of those areas with lower concentrations must be mined unless new reserves are found. That does happen so all these things occur simultaneously. Mining mineral ores with lower concentrations means several things. First, it means that the economics will be less favorable than in projects with higher concentrations. Second, there will be more ore to process for a similar amount of mineral. This also means that ore waste will be increased per kg of mineral produced. This may result in higher net impacts to the environment vs. Higher concentrated deposits. This is currently happening with copper and a few other minerals and is a matter of concern for the clean energy transition which calls for quite a large amount of copper. Below is a 2016 USGS graph of historical global copper production and a forecast of global copper production to 2100.

Cost and Complexity of Mineral Processing

The cost of

mineral processing is always a factor in determining economically recoverability

of minerals. That cost is determined by its complexity. Processing is often

called refining and compared to oil refining, which cost similarly ties into

oil reserves calculation. New methods of mineral processing may become cheaper

per unit of mineral processed as they are implemented.

Oil & Gas-In-Place, or Resource-In-Place

For oil and gas, the

Original Gas-in-Place (OGIP), aka. Gas-Initially-in-Place (GIIP) is ideally to

be determined for gas reserves evaluation. This can be done before or during drilling

and production. The calculation requires an estimation of the available pore

space in the rock and the connectivity of that pore space (permeability), and

the oil and/or gas saturation, which for gas is dependent on pressure, gas

charge, water saturation, and other factors. Two summarized formulas for gas-in-place

are shown below:

GIIP = Gross Rock Volume * Net/Gross * Porosity * Average

Initial Gas Saturation / Formation Volume Factor1

Another equation for calculating gas in place is: G =

43,560 x A x h x φ x (1 - Sw) ÷ Bg × E234

Where A = area, h = net pay, φ = porosity, Sw = water

saturation, Bg = gas formation volume factor, and E = recovery efficiency.

The detailed formulas are much longer and involve several

additional calculation steps to arrive at the main variables. For oil, original

oil-in-place, or stock tank original oil-in-place (STOOIP) is distinguished

from remaining oil-in-place, which is sometimes just called oil-in-place. A

simplified STOOIP calculation formula is shown below.

Recoverable Reserves

Resource estimates,

including resource-in-place estimates, are not the same as reserves. Reserves

must be recoverable, whether technically (with current technology), or

economically. Pricing is always a factor in economic recoverability since

profit is required for businesses to succeed.

Technically Recoverable Reserves

Technically

recoverable reserves refer to those reserves that could be developed with

current technologies but may not be economically viable to do so. Cost is a

barrier to development even though we know the resources are there. With new

technological developments, technically recoverable reserves can be reclassified

as economically recoverable reserves. That is what happened with shale gas and

oil as the new technologies of high-volume hydraulic fracturing and horizontal

drilling tech unlocked new supplies that became economical. The reserves are

there and may someday be profitably extracted when technology improves

Economically Recoverable Reserves

Economically

recoverable reserves depend on technology as stated above but they also depend

on commodities pricing. Prices for oil, gas, coal, and minerals fluctuate

according to supply-demand dynamics. Companies selling commodities must always consider

pricing to determine profitability. Fluctuation in profitability due to pricing

can lead to busts and booms and supply-demand cycles that can have some

predictability.

The Society of

Petroleum Engineers (SPE) recognizes three categories of reserves:

Possible Reserves

Possible reserves

are those reserves with the “odds of commercial extraction under 50-percent,

but higher than 10-percent,” according to SPE.

Probable Reserves

Probable reserves

are “those with the likelihood of recovery for between possible and proved

reserves, or over 50-percent but under 90-percent,” according to SPE.

Both possible and

probable reserves are not yet proved, so they are deemed unproven. The difference

between proved and unproved reserves is the degree of certainty about whether

those reserves will be developed. These designations often change with pricing.

If the price of a commodity rises so too doe the likelihood of development of

more resources so some possible reserves will be reclassified as probable reserves

and some probable reserves will be reclassified as proved reserves.

Proved Reserves (Developed and Undeveloped)

Proved, or proven

reserves have “a 90-percent or above likelihood of commercial extraction,”

according to SPE. Proved reserves may be developed or undeveloped. In the case

of oil and gas proved developed reserves are those that are in the various

stages of being produced, from new wells with flush production to old wells

with steady but much lower production. Proved developed reserves are those

reserves that are expected to be recovered from existing wells. Proved

undeveloped are those reserves that are expected to be developed in the future

with new wells, These may include deepening existing wells or some kind of

enhancement like recompletion or a ‘refrac’

of the well. The SEC requires oil and gas companies to delineate their proved

developed and proved undeveloped reserves.

Finding Costs and Lifting Costs

Finding costs are

simply the costs to explore for, discover, and develop a resource. The Energy

Information Administration (EIA) describes finding coats as follows:

“Finding costs are the average costs of adding proved

reserves of oil and natural gas via exploration and development activities and

the purchase of properties that might contain reserves. These costs are

measured for oil and natural gas on a combined basis in dollars per boe.

Ideally, finding costs would include all costs incurred (no matter when these

costs were incurred or recognized on a company's books) in finding any

particular proved reserves (not including the purchases of already discovered

reserves). In practice, and as reported here, finding costs are actually

measured as the ratio of exploration and development expenditures (including

expenditures on unproved acreage but excluding expenditures on proved acreage)

to proved reserve additions (excluding net purchases of proved reserves) over a

specified period of time. Finding costs are generally calculated in Performance

Profiles as a weighted average over a period of 3 years.”

Lifting costs are the costs to operate and maintain wells. According

to the EIA:

“Lifting costs (also called production costs) are the costs to operate and maintain wells and related equipment and facilities per barrel of oil equivalent (boe) of oil and gas produced by those facilities after the hydrocarbons have been found, acquired, and developed for production. 15 Direct lifting costs are total production spending minus production taxes (and also minus royalties in foreign regions) divided by oil and natural gas production in boe. Total lifting costs are the sum of direct lifting costs and production taxes.”

U.S. Oil and Gas Reserves and Finding Cost Changes Over the Past Decade

The graphs that follow show the changes in proved reserves and

finding costs for U.S. oil and gas companies from 2014 through 2023.

References:

Public

company proved oil and natural gas reserves were mostly unchanged in 2023.

Energy Information Administration. Today in Energy. August 12, 2024. Public

company proved oil and natural gas reserves were mostly unchanged in 2023 -

U.S. Energy Information Administration (EIA)

Decline

curve analysis. Wikipedia. Decline

curve analysis - Wikipedia

Production

forecasting decline curve analysis. PetroWiki. Production

forecasting decline curve analysis - PetroWiki (spe.org)

What

Are Decline Curves? Brookside Energy. October 2022. Oil-and-Gas-Well-Decline-Curves-Explained-v.2.pdf

(brookside-energy.com.au)

5.2:

Estimation of Original Gas In-Place, OGIP, Using the Volumetric Method. PNG 301.

Introduction to Petroleum and Natural Gas Engineering. Penn State University College

of Earth and Mineral Sciences. 5.2: Estimation of

Original Gas In-Place, OGIP, Using the Volumetric Method | PNG 301:

Introduction to Petroleum and Natural Gas Engineering (psu.edu)

Estimation

of gross calorific value of coal: A literature review. Lethukuthula Vilakazi

&Daniel Madyira. International Journal of Coal Preparation and Utilization.

April 14, 2024. Full

article: Estimation of gross calorific value of coal: A literature review

(tandfonline.com)

Energy

value of coal. Wikipedia. Energy

value of coal - Wikipedia

U.S.

Coal Resources and Reserves Assessment. Central Energy Resources Science Center.

U.S. Geological Survey (USGS). November 30, 2018. U.S.

Coal Resources and Reserves Assessment | U.S. Geological Survey (usgs.gov)

Which

countries have the world’s largest coal reserves? Visual Capitalist Elements.

Mining.com. September 15, 2021. Which

countries have the world’s largest coal reserves? - MINING.COM

Geology

and Mining: Mineral Resources and Reserves: Their Estimation, Use, and Abuse. Simon

M. Jowitt; Brian A. McNulty. SEG Discovery (2021) (125): 27–36. Geology

and Mining: Mineral Resources and Reserves: Their Estimation, Use, and Abuse |

SEG Discovery | GeoScienceWorld

Mineral

resource estimation. Wikipedia. Mineral

resource estimation - Wikipedia

Probable

Reserves: What it Means, How it Works. James Chen Updated July 13, 2022. Reviewed

by Erika Rasure. Investopedia. Probable

Reserves: What it Means, How it Works (investopedia.com)

How

Oil Companies Record Oil Reserves on Their Balance Sheets. Chizoba Morah

Updated June 17, 2022. Reviewed by Thomas Brock. Investopedia. How

Oil Cos. Treat Reserves on a Balance Sheet (investopedia.com)

Performance

Profiles of Major Energy Producers 2009. Energy Information Administration. February

25, 2011. U.S.

Energy Information Administration - EIA - Independent Statistics and Analysis

Mineral Resources: Reserves, Peak Production and the Future. Lawrence D. Meiner, Gilpin R. Robinson. And Nedal T. Nassar. U.S. Geological Survey. Resources 2016, 5(1), 14. Resources | Free Full-Text | Mineral Resources: Reserves, Peak Production and the Future (mdpi.com)

No comments:

Post a Comment