This post is a

review and summary of a great article put out by Wood MacKenzie - Mission invisible: Tackling the oil and gas industry's methane problem - that has some

clear and detailed data about methane emissions by source, U.S. basins,

regions, and countries. Knowing this data helps to clarify goals and

opportunities.

The scope of the

problem is that methane from all sources, including naturally occurring sources,

is responsible for nearly a third of global warming. Methane from oil & gas

systems makes up about a quarter of that total. Thus, methane emissions from

oil and gas are thought to be responsible for nearly 9% of global warming. If that

can be reduced by 30% by 2030 as the Global Methane Pledge aspires to do, then

that would bring the oil & gas contribution to global warming down closer

to 6%. However, the problem with this is that not all countries are equally

devoted to methane emissions mitigation so it may not be a realistic goal, even

if some dedicated countries can reduce further than 30%. It is doable in theory,

but it is not clear if it is doable in practice.

One of the

challenges of methane abatement is simply getting accurate measurements of leak

sites and leak rates at each site. Satellite measurements can be very helpful

but do not quantify leak rates at sufficient resolution. WoodMac classifies

leaks as ‘super-emitters’ – those very large leaks that can be easily seen with

satellites but are few in number, and ‘snowballers’ – much smaller leaks that

are much greater in number and often go undetected. While super-emitters grab

headlines and offer great advantages in abatement, the cumulative impact of the

snowballers adds up to the biggest impact by far.

The following graph

is the best and most comprehensive one I have seen on methane emissions by

source. However, many researchers think that anthropogenic methane leakage is

underestimated from all sources.

Smaller

emissions come from deliberate venting and flaring as well as valves, pneumatic

devices, venting from tanks and wellheads, and incomplete combustion in

generators and flare stacks. The graph below shows emissions relative to Permian

emissions (at 100%). WoodMac notes that leakage estimates vary widely, with

most suggesting that they are underestimated and that they are challenging to

identify and quantify.

Better detection

and data accuracy for smaller leaks are needed but are often difficult to obtain.

The main methods of detection are: “satellites, aircraft, drones, regional

sensors, point sensors and, most commonly, optical gas imaging (OGI) cameras.”

Better spatial, spectral, and temporal resolution are needed for satellite leak

detection and quantification. There are three classes of satellites in

operation, or about to be in the case of one. The first type (class1) has been

in operation for a while and can provide data on average GHG concentrations over

large areas. The second (class 2) will begin ops in 2024 as Environmental Defense

Fund’s MethaneSAT is deployed. It will measure concentration changes over time,

providing better temporal resolution. It is expected to cover 80% of oil&

gas sector emissions and will pick up both point-source emissions and dispersed

area sources. It is expected to provide better emissions estimates than previous

satellites. The third type (class 3) focuses on point-source emissions but does

not include wider coverage. The data can be integrated. One goal is to

establish average emissions per typical field, which is often below the

resolution of satellites at less than 500 kg/hr (around 0.65 mmcfd). Geostationary

satellites provide great temporal resolution, but orbital satellites provide

better spatial resolution. The nature of the methane molecule as highly

dispersive (it can travel far quickly) makes pinpointing the actual emissions source

of leaks difficult. Weather and atmospheric data can help in this regard. Detection

over surface waters is also difficult due to spectral similarities of water and

other atmospheric components, particularly over rough seas. This makes satellite-based

leak detection and analysis tough for offshore facilities. Increasing spectral

resolution with more finely tuned spectrometers is the key to resolving this

issue. WoodMac gives an interesting example of satellite data from different

types over the large Aliso Canyon gas storage field leak in 2015 that shows the

limitations of satellite data.

The Global

Methane Pledge, launched at COP26 in the fall of 2021, covers about 45% of

global emissions but does not cover the world’s three biggest emitters: Russia,

China, and India. Global partnerships include the Oil and Gas Climate

Initiative (OGCI), a group of 12 large producers, and the Oil and Gas Methane

Partnership 2.0 which includes 110 companies. The U.S. has fines set to go into

effect in 2024 at $900 per mt with increases to $1200 per mt in 2025 and $1500

per mt in 2026. The E.U. is working on comparable rules. Canada hopes to

decrease emissions by 75% from 2012 levels by 2030. The efforts by the E.U. and

Canada are enforceable through their compliance with carbon markets. Columbia and

Nigeria are the first countries in South America and Africa, respectively, to regulate

methane emissions, although Nigeria has a long way to go due to both extensive

flaring and venting and illegal and dangerous processing and refining

operations. China is exploring regulations. India has delayed and is not ready.

Russia, the world’s largest methane emitter, likely has no plans to regulate. WoodMac

notes that the OGCI companies have already reduced emissions by 45% over the

past five years so that tells us that with the right amount of investment and

the will to do it, it is doable.

While

super-emitters can be cost-effective to fix, the smaller leaks are not and

require the will to do so if voluntary or regulations. Incentives can help

companies address these more expensive-to-fix leaks. Carbon markets and premium

pricing for methane-abated natural gas are examples. More buyers, particularly

in Europe, are demanding methane-abated gas. WoodMac notes another approach

that has been developed for orphan and abandoned wells: methane leak reduction as

a service: “Methane reduction as a service may also have a future. This is

currently monetised in the relatively uncertain offset market amid growing

interest. The American Carbon Registry recently published a methodology to

generate offsets from plugging methane leaks resulting from orphan and

abandoned oil and gas wells. While prices for these offsets remain low, as more

stringent regulations come into play those offsets should become more valuable.”

It appears that

as certain countries lag behind in emissions reduction, they will have fewer

places to sell their gas. Russia is key here as one of the world’s largest

producers and exporters. They continue to enjoy selling to their fellow laggards,

India, and China but others will drop them as time goes on. As the methane

mitigation industry grows, as emissions become better quantified, and as leak

detection equipment drops in price, those without access to mitigation will

gain it, especially if goaded by regulations and lost sales.

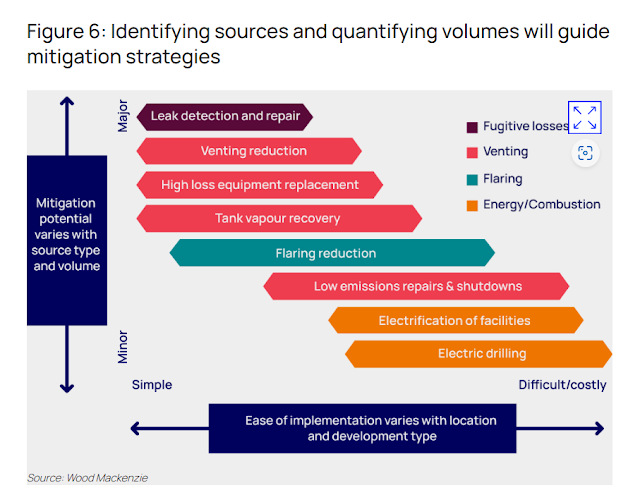

The following

graph shows the easiest and hardest. The cheapest and costliest means to reduce

GHGs in the oil & gas sector. Clearly, leak detection & repair, venting

reduction, high-loss equipment replacement, tank vapor recovery, and flaring

reduction are the low-hanging fruits and should and will be addressed first.

Government

support for emissions reductions can be in the form of regulations and

enforcement such as fines and financial support for technology development. The

IRA in the U.S. appropriates $350 million for help in monitoring and reducing

methane emissions. Canada has offered $113 million (CND) for sector

decarbonization. WoodMac cautions against over-emphasis on satellite data and

suggests improving integration of all data and avoiding duplicative costs for

emitters. Addressing the myriad of smaller leaks will remain challenging. Penalties

and incentives, carrots and sticks, will both be employed.

References:

Mission

invisible: Tackling the oil and gas industry's methane problem. Elena Belletti,

Global Head of Carbon Research, Adam Pollard, Principal Analyst, Upstream

Emissions, Ryan Duman, Director, Americas Upstream, Fraser McKay, Head of

Upstream Analysis, Nuomin Han, Head of Carbon Markets. Wood MacKenzie. November

2023. Mission

invisible: tackling the oil and gas industry's methane challenge | Wood

Mackenzie

Natural

Gas and Decarbonization: Key Component and Enabler of the Lower Carbon,

Reasonable Cost Energy Systems of the Future: Strategies for the 2020s and

Beyond. Kent C. Stewart. Amazon Publishing, 2022.

No comments:

Post a Comment