While politicians

will sometimes say that we can lower U.S. gasoline and diesel prices by

producing more gas here at home, that is really not the case. Increased

domestic production can affect international crude oil prices some and since

international crude oil prices affect refined product prices (such as gasoline

and diesel) there is some effect on them. However, this effect is generally

muted, especially when other major producers like those in OPEC+ are limiting

production as they are now.

Political Party and Presidential Support for Increased

Production Has a Limited Effect as Well

The Washington

Post had an informative article investigating whether U.S. crude oil production

increases affect U.S. gasoline prices and comparing Trump’s and Biden’s

policies to U.S. crude production and gasoline prices. Oil production did

increase more under Trump but also increased under Biden, after the Covid drop.

Despite the rhetoric of politicians, these production increases have limited effects

on gasoline prices. There is no correlation in the data between U.S. oil

production and U.S. gasoline prices, although there is a rightly assumed

influence.

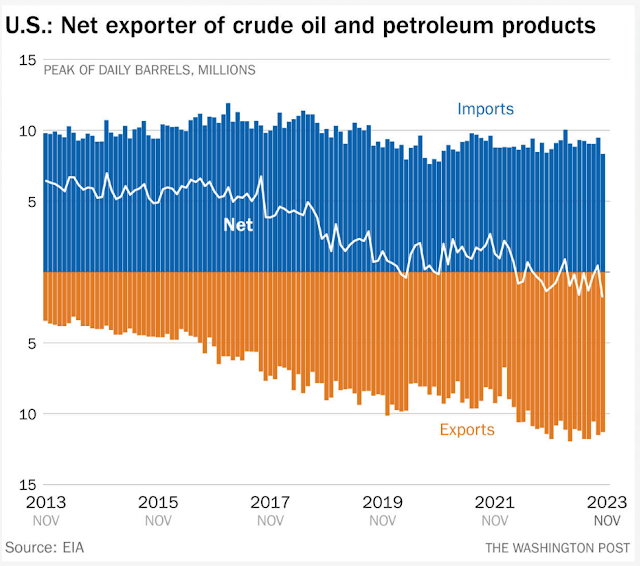

The same article also

shows that Trump’s claim that the U.S. became more energy-independent under his

leadership is partially verified in the data. It was Obama who ended the ban on

exporting U.S. crude oil. That oil began flowing overseas in late January 2016,

about a year before Trump took office. Exports of crude oil and petroleum

products increased until they were hobbled by demand losses due to Covid. They

resumed those increases in late 2021-early 2022, increasing further in 2022 as Russian

oil was sanctioned. The graphs below show that if we include petroleum product

exports with crude oil exports the U.S. became a net exporter briefly in early

2020 and more steadily in early 2022. The later increase had much to do with

bans on Russian petroleum products. The second graph below shows that U.S.

imports of oil and petroleum products actually peaked in 2006-2007.

If only crude oil is

considered, we are still very much a net importer of about 4 to 5 million

barrels per day (bpd). The maximum net imports of crude oil were about 8

million bpd in 2016. Oil exports grew from about 0.5 million bpd to about 4

million bpd from 2016 through 2019 then dropped and hovered from 3 to 4 million

bpd through 2021. Beginning in 2022 till now they have hovered at about 5

million bpd. Thus, net exports have also increased significantly under Biden,

although much of that increase is attributable to the loss and restriction of

Russian crude on world markets.

While Trump clearly had a more favorable approach to aiding

and growing U.S. oil production and exports, they have both grown significantly

under Biden as well. The difference between the two is mainly carbon emissions.

Trump expressed no concern about carbon emissions while they are a key feature

of Biden’s policy initiatives. The article points out that if the U.S. were

really energy independent, we could increase gasoline by increasing domestic oil

production by decoupling from dependence on the international market. That is

only partially true. The reason is that U.S. refineries are by and large designed

to process heavy sour crude rather than the light sweet crude produced in the

most productive U.S. basins such as those of the Permian and Bakken. In the

debate over presidential support of domestic gasoline prices, one can say that

Biden was most unsupportive by canceling the Keystone XL pipeline which would

have brought in more heavy crude from Canada that can be readily refined by

U.S. refineries. The U.S. already gets most of its crude oil imports from

Canada. Canada overtook OPEC as the largest supplier of imported U.S. crude in 2015

as the following graph from 2020 shows.

What Does Affect U.S. Gasoline Prices?

RBN Energy has

some informative content in its blog about what affects gasoline prices. Most

of that info is now behind a paywall but some of the variables include octane

prices, the new Tier 3 sulfur rule, what type of crude refineries are designed

to process, total refinery capacity, and at what percentage of total capacity

is functioning on average. Refiners met with U.S. government officials in the

summer of 2022 when gasoline prices were high to explain the situation and to

brainstorm solutions. The Tier 3 sulfur requirements were delayed. These are

very expensive to implement at hundreds of millions per refinery. Total

refinery capacity has also been affected by a small percentage of that capacity

being re-outfitted to refine renewable diesel rather than crude. While the

percentage converted to refine renewable diesel is small, it can affect

gasoline prices since refineries have been running at high capacity. It was at

just 0.4% in 2020 but has grown a little more in the past few years. Renewable

diesel nameplate refining capacity is expected to double by 2026 but it is unclear

how much, if any, of that increase will replace crude refining. Renewable

diesel is a “drop-in” fuel for diesel consumers but is sold at a higher price

due to its decarbonized credentials. No major new refineries have been built in

the U.S. for many years (since 1977) and none are expected. There are some

small refineries in planning that hope to process small amounts of U.S. sweet

crude from the Permian Basin. I wrote about them in March in a post about modularity

in construction.

According to

Wikipedia, the EIA, World Economic Forum, and other sources, an online search

query about what affects U.S. gasoline prices yields the following:

Factors that affect the price of gasoline in the United

States include:

1)

The price of crude oil per barrel

2)

Costs and profits related to refining,

distribution, and marketing

3)

Taxes

4)

The charge set by refiners for gasoline based on

octane levels, with higher octane levels costing more than regular grade

5)

Distance from supply

6)

Supply disruptions

7)

Retail competition and operating costs

8)

Proximity to supply

9)

Competition with other gas stations

10) Environmental

programs

World Economic Forum and EIA break it down into four main factors

and their weight by percentage as follows:

Crude oil prices (54%) (this should emphasize international

prices rather than domestic prices)

Refining costs (14%)

Taxes (16%) (taxes per gallon vary by state)

Distribution, and marketing costs (16%)

What is the Current Supply/Demand Dynamic for International

Crude Oil?

Lower crude oil

prices in recent weeks have been a little unexpected. The Saudi oil experts

believe it is a deceptive and temporary drop. They did, however, extend OPEC+ production

cuts till at least the end of the year. The Saudis say it is a ploy by speculators

and oil demand is not weak. Oil shipments increase seasonally in September and

October which can give a temporary drop in prices that does not reflect supply

and demand dynamics. The Saudi/OPEC+ announcement a few months to extend

production cuts did briefly cause a rise in prices and perhaps this is their

own reusable “ploy” to increase prices when needed. OPEC expects increased demand of 2 million bpd in 2024 while IEA expects a lesser increase at 800,000 bpd. Many have expected higher

oil prices due to the Israel-Hamas war but that has yet to occur. Some analysts

predict an avg. crude price of $118/Bbl in 2024 after an avg. of $80/Bbl

in 2023. If one were to apply the 54% effect of crude prices on U.S. gasoline

prices that would equate to a 50-60 cent rise in gasoline prices for 2024. I

hope that is not the case for those prices really affect me.

References:

It’s time to update

your talking points about oil production. Philip Bump. Washington Post.

November 9. 2023. It’s time to update your talking points about oil

production (msn.com)

The drop in oil

prices is just a 'ploy' as speculators pretend demand is weak, Saudi Arabia

energy minister says. Jennifer Sor. Markets Insider. November 10, 2023. The drop in oil prices is just a 'ploy' as speculators

pretend demand is weak, Saudi Arabia energy minister says (msn.com)

Don’t Be Lulled By

Oil’s Recent Drop. Higher Prices Are Coming. Randall W. Forsyth. Barrons.

November 10, 2023. Don’t Be Lulled By Oil’s Recent Drop. Higher Prices

Are Coming. (msn.com)

OPEC is Now Obsolete:

Oil Crisis Update. Matt Badiali. January 13, 2020. Banyan Hill. OPEC Is

Now Obsolete: Oil Crisis Update (banyanhill.com)

Petroleum and Other

Liquids: U.S. Imports by Country of Origin. Energy Information Administration. U.S.

Total Crude Oil and Products Imports (eia.gov)

Overview of the

Production Capacity of U.S. Renewable Diesel Plants through December 2022. March

13, 2023. Maria Gerveni and Scott Irwin.

AgFax. Overview

of the Production Capacity of U.S. Renewable Diesel Plants through December

2022 – AgFax

Explainer. What

drives gasoline prices? We Forum. June 16, 2022. Here

are the four main factors driving up US gas prices | World Economic Forum

(weforum.org)

No comments:

Post a Comment