When it comes to

carbon intensity, not all U.S. basins are equal. There are several reasons for

this. Dry gas plays are easier to mitigate for methane since methane dissolved

in oil and condensate does not need to be considered. Gas flaring is confined

mainly to oil plays. The 2021 graph below from Rystad shows the variation in

carbon intensity among U.S. shale oil & gas basins. I added the indicators

to the graph.

US Basins: Upstream Scope 1 CO2 emissions intensity. Adapted from Rystad (2021)

Platts, a part

of S&P Global Commodity Insights recently announced a launch of monthly

carbon intensity measurements for eight market locations in the U.S. These will

serve as a measure for what would probably be considered to be a voluntary

carbon market since it includes “associated carbon-accounted price

assessments.” This effort is another in a series of emissions benchmarking

protocols across the industry. Kevin Birn, Global Head of Center of Emissions

Excellence, S&P Global Commodity Insights, said: "We're excited to

be offering our clients and the marketplace this truly unique assembly of

carbon intensity insight that brings transparency to carbon across the value

chain of natural gas -- from upstream production, gathering and boosting, and

gas processing, to transport and amalgamation into market hubs. Not only is the

offering unparalleled in detail and complexity, but it enables and facilitates

the benchmarking of carbon and aids its incorporation into asset and commodity

valuations."

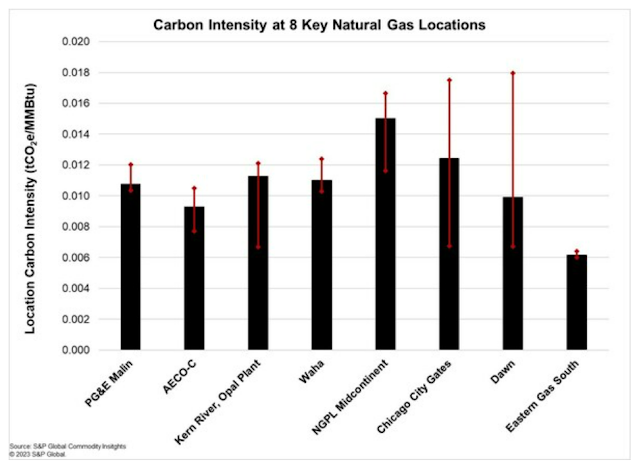

The different

market hubs can be seen in the graph below. They represent blends from multiple

basins but still reflect the main basin of origin in some cases. For instance, the

low emissions intensity of Eastern Gas South reflects the low emissions

intensity of the Marcellus and Utica regions which are mainly dry gas plays.

S&P Global notes: “Lowest carbon-intensity locations are those with

shorter transport distances from basin to hub, less processing requirements

(i.e., dry sweet gas) and lower methane emissions throughout the supply chain.”

They also note that emissions intensity will vary over time and can vary dramatically

by company. They will also publish “a

daily associated carbon-accounted natural gas price assessment for each

location, expressed in US dollars per MMBtu, and using the Platts Carbon

Removal Credit Assessment (Platts CRC).” These efforts will bring and keep emissions

intensity into clear focus.

In the U.S. an

EPA fine on methane emissions is expected to go into effect in 2024 at $900 per

metric ton emitted, increasing to $1200 per metric ton in 2025, and $1500 per

metric ton in 2026.

Measurement, reporting, monitoring, and verification

efforts have been undertaken for a few years now as part of the responsible gas

or certified gas protocols. This can be difficult due to the variability of

sources and rates of methane leakage from upstream to downstream in the

industry. Leaks can also be intermittent. Gas Technology Institute’s Veritas

protocol is developing industry standards for comparable measurement. Verification

is by direct field measurements, many with continuous monitoring. Certification

is mainly through the MiQ certification standard that has been widely adopted.

Methane emissions are also double-checked with independent third-party

satellite data from government agencies and environmental groups like the Environmental

Defense Fund (EDF), which has launched satellites to measure methane emissions globally

with good resolution.

Meanwhile, the

E.U. has just reached an agreement to reduce methane emissions from the oil

& gas and coal sectors within the E.U. This requires companies to “properly

measure, monitor, report and verify their methane emissions according to the

highest monitoring standards, and take action to reduce them”. The same

requirements for imports are expected to go into effect in 2027. This does not

bode well for countries like Russia. While Russia’s pipeline-imported gas

volumes to the E.U. are now very low, their LNG exports to the E.U. have risen

by significant amounts. Russia is known to have high methane emissions and is

not expected to be a fair player in emissions reductions. Since LNG has a significantly

higher carbon intensity than pipelined gas, this has resulted in emissions

rising in the E.U. due to the increase in LNG imports to Europe from the U.S.,

Russia, and elsewhere. Previously stated goals are to reduce methane emissions

globally by 30% by 2030. This is likely achievable, at least among responsible countries.

One issue that could cause problems is aging infrastructure which is more prone

to leaking. Countries such as Russia, Ukraine, Turkmenistan, and Azerbaijan have

this problem. That makes it more expensive for them to come into compliance. EDF’s

European division estimated that the E.U.’s LNG carbon footprint is about 8

times higher than its domestic footprint.

Thus, one can

see that the Russian invasion of Ukraine disrupted European decarbonization plans

in many ways: increase of LNG/reduction of pipelined gas, the blowing up of the

Nordstream gas pipeline which resulted in significant releases of methane directly

into the atmosphere, and the higher costs of energy which took away spending

that could have been applied to decarbonization efforts, and exacerbated inflation.

References:

A gas boom is coming in the US, a closer look at

Haynesville and Appalachia reveals records and a risk. Rystad Energy. April 22,

2021. Rystad

Energy - A gas boom is coming in the US; a closer look at Haynesville and

Appalachia reveals records and a risk

S&P Global Commodity Insights Launches Carbon Intensity Measures & Carbon-Accounted Price Assessments for North America Natural Gas Markets. S& P Global. November 15, 2023. S&P Global Commodity Insights Launches Carbon Intensity Measures & Carbon-Accounted Price Assessments for North America Natural Gas Markets | S&P Global Commodity Insights (spglobal.com)

EPA’s

Methane Rulemaking Timeline. Harvard Environmental & Energy Law Program.

July 13, 2023. EPA’s

Methane Rulemaking Timeline - Harvard Law School

How to

Cut Methane Emissions from Global Gas. Ben Cahill & Arvind Ravikumar.

Center for Strategic and International Studies. November 14, 2023. How

to Cut Methane Emissions from Global Gas (csis.org)

Oil

and gas industry jittery as EU nears deal on methane leakage. Nikolaus J.

Kurmayer. Euractiv.com. November 13, 2023. Oil and gas industry jittery as EU

nears deal on methane leakage – EURACTIV.com

EU

reaches deal to reduce methane gas emissions from energy sector. AP. The Irish

News. November 15, 2023. EU

reaches deal to reduce methane gas emissions from energy sector (msn.com)

GTI

Energy's Methane Emissions Measurement and Verification Initiative. Gas Technology

Institute. Veritas:

GTI Energy's Methane Emissions Measurement and Verification Initiative • GTI

Energy

No comments:

Post a Comment