We often hear the phrase “slapping a

tariff” on a country, typically an adversary. No one likes to be slapped, it

hurts. But a slap just hurts the one slapped. A better analogy is perhaps a

headbutt. It may be common in the world of mostly male ruminant mammals with

horns or antlers, but in the immortal words of Paul Blart “Nobody wins with

a headbutt.”

Free trade is

considered to be a cornerstone of modern prosperity, keeping product costs low

for all. As we embark on a trade war with our biggest trading partners and our

friendly neighbors (that’s right, an economic war with our friends) what can we

do? Nothing, just wait and see what happens to prices. I like avocados and I

like that they are affordable, but that may change. If oil is not exempted, it

will likely affect gasoline prices. That would hurt like a headbutt.

The U.S. has

among the lowest tariffs (at least before today). We can easily justify upping

our tariff rates by a few percentage points, as Trump’s newly confirmed Treasury

Secretary has noted. Below is a graph of average tariff rates. If Trump’s new

tariffs stay our average will likely be close to India’s average. Free trade means

tax-free trade or tariff-free trade.

Trump’s Tariff Threats are a Result of His Focus on

Distributional Negotiation

Since it is

obvious that trade tariffs are effectively a tax on both parties, the situation

is that Trump is saying: if you don’t do what I want I will hurt you and I will

also hurt us, and since costs disproportionately fall on the poor since they would

be a bigger percentage of their income, he is effectively saying I will hurt

you as well as the poorest among us. It is an across-the-board tax. Trump

indicated that tariffs are coming for the E.U. as well. When Trump won the election,

I expressed the hope that he would continue to go after adversaries and problem

countries and not do stupid things like threaten Canada and the E.U. I lost

that hope since he is hell-bent on punishing our allies. While I am sympathetic

to and do understand his concerns about trade deficits, immigration, and

fentanyl, we are a country that generally consumes more than we produce, except

in some key areas like energy and food. If we want to become a manufacturing economy,

we have to be able to produce things cheaper than other countries. That means more

minimum or low-wage labor. We have benefitted immensely from the cheap labor of

other countries, including China and Mexico. They have benefitted as well. We are

wealthier than most countries. We buy more than most countries. Thus, it is no

surprise that we are net importers. We are also the world’s biggest and most successful

economy, even with trade deficits.

Trump’s threats

are not concerned with us re-orienting toward domestic manufacturing, but with

using threats of tariffs and now enacting tariffs, to impose his will on

others. It is a negotiating tactic that some have called distributional bargaining

where there is always a clear winner and a clear loser. However, negotiations can

also be integrative, often where both sides compromise and agree to an outcome

that benefits both in some ways. Trump is essentially gambling with our money.

By the way, I hate to have to write about Trump or Musk, but they dominate our

news so much and their decisions affect us to the point where it is difficult

to avoid.

In 2018 Indiana professor David Honig was interviewed by NPR’s Elsa Chang about tariff threats

He noted how real estate transactions were characterized in Trump’s book “Art

of the Deal.” Honig talked about distributive bargaining and integrative bargaining.

Interestingly, he noted that while distributive bargaining can be successful in real estate transactions, its success in geopolitical relations is less

likely. In those cases, integrative bargaining achieves better results as he

explains.

“And when you look even at his own book, in the pure

real-estate environment, it did serve him well. But when the deals that he was

seeking went beyond simple real estate purchase and sales, ownership of a

professional football team or his casinos, where the deals were more complex

and had a lot more involved than just buying and selling something of value,

they did not ultimately work out well for him. Sometimes, you have to deal with

people again. And if you've taken them, or they feel like they've been taken,

they're not going to deal with you again. You can do that with a cabinet maker

who put the cabinets in your hotel or casino because you can find another

cabinet maker. But you can't find another Canada. You can't find another China.”

He describes integrative bargaining in terms of value taken

and value added:

“So when you're value taking, there's a limited pie. You

want as much as you can. When you're value adding, you're looking at how you

can create value for the other side. The other side can create value for you.

And, therefore, ultimately, you walk away with a deal that you both want.”

Honig also noted what

happened then when Trump put tariffs on Chinese goods:

“When we imposed tariffs on China, and China responded by

terminating all of the soybean orders with the U.S., not only do the farmers

suffer here in the United States. China buys their soybeans from Russia.”

Perhaps that is good from an emissions perspective since Russia is closer to China. However, this ended up limiting our ability to leverage sanctions power against Russia.

Tariff Effects

25% tariffs on

Canadian and Mexican goods will no doubt be problematic. They will also damage and

perhaps destroy the Cananda-Mexico trade agreement that Trump negotiated with

pressure in his first term.

“Tariffs at those levels and at that scope would

effectively destroy the agreement that Trump himself negotiated and always

brags about,’’ said Scott Lincicome, a trade analyst at the libertarian Cato

Institute.

AP’s Paul Wiseman notes that the trade deficit with Mexico

has widened, mainly due to Mexico replacing China as a source of lots of goods

due to Trump’s previous tariffs on China. That too is good from an

emissions perspective since Mexico is closer to the U.S. The trade deficit with Canada has also widened since then,

with the bulk of that due to growing exports of Canadian oil to the U.S. for

refining, with some exported. Canadian oil imports are at a record 4.3 million

barrels per day. Of course, we need that oil, and Canada is the best place to

get it. It is a heavy crude oil that our refineries are outfitted to process. There

is not enough refinery capacity here to process American light crude, so we

export a lot of it. There has not been a refinery built in America since 1977. Thus,

we really need that Canadian oil. It is cheaper than getting it from elsewhere.

According to AP:

“The threatened 25% tariffs are causing heartburn in

corporate boardrooms. If Trump goes ahead with his threat, tariffs would surge

from $1.3 billion to $132 billion a year on Mexico’s imports to the United

States and from $440 million to $107 billion on Canada’s, according to the tax

and consulting firm PwC.”

“And no one knows if Trump will really pull the trigger

or how long the tariffs would stay in place if he does. “It’s really thrown

industry into this turmoil of anxiety,” said trade lawyer Chandri Navarro,

senior counsel at Baker & McKenzie. “What industry likes is certainty.

You’re making production decisions, supply chain decisions, purchasing

decisions five years out.’’

“Trump views tariffs as a fix-it for most of what ails

the economy. He says they raise money for cuts in income and corporate taxes,

encourage companies to move production to the United States and offer useful

leverage in pressuring other countries to make concessions on trade and other

issues.”

Companies have

complained for many years about regulatory uncertainty affecting their

decisions and bottom lines. Now we have tariff uncertainty, where they don’t

know how much and how long they will be subject to higher costs as countries

immediately retaliate tit for tat.

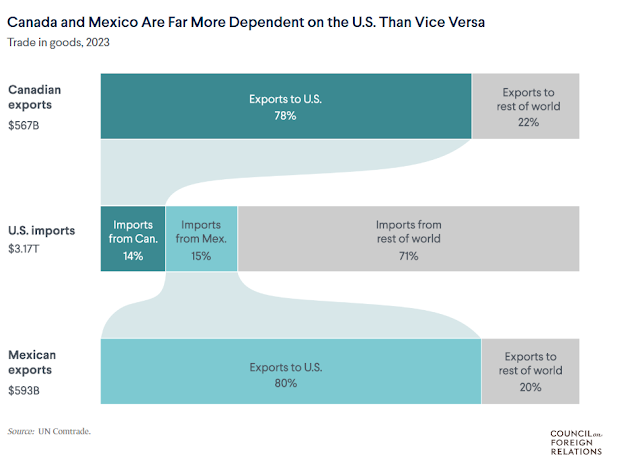

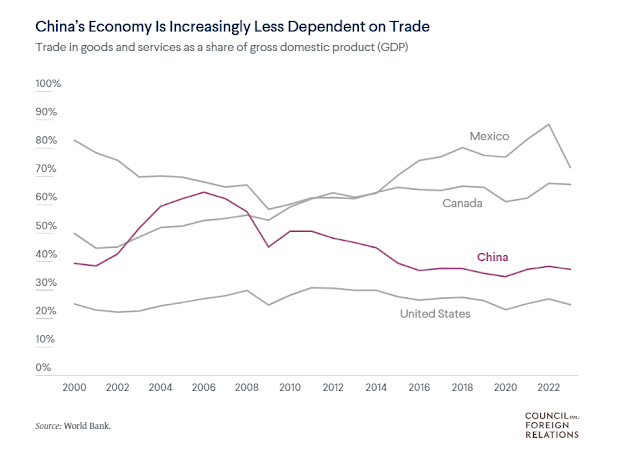

Trump is known for

using leverage any chance he gets even when his leverage is questionable. In

this case, it is not since the economies of Mexico, Canada, and China are more

dependent on trade than the U.S. although China is less dependent on trade than

Mexico and Canada. Canada may have more leverage in the oil-exporting realm

since we are definitely dependent on Canadian oil, which is a godsend that has

destroyed our vulnerability to OPEC-plus countries.

RBN Energy is an

energy analysis group that has a great blog that titles its posts with song

titles. For tariffs, they used REM’s “Everybody Hurts,” echoing the view of the

vast majority of economists. When everybody pays then everybody hurts. But, as

noted, everybody doesn’t hurt equally. No, the poor hurt more because when

everybody pays, they must pay out a bigger chunk of their total cash.

The Council on Foreign Relations analyzed Trump’s trade war in nine charts, all of which are shown below. It is useful data on trade deficits, trade dependencies, and trade volumes.

Tariffs as a Tool: Use Wisely but Only When Warranted

Of course, tariffs

can and have been used as a tool of influence. The tariffs on Chinese solar

panels due the use of slave labor and other moves against unfair labor

practices were warranted with wide bipartisan support. The E.U. is attempting

to not buy gas from Qatar due to their unfair labor practices. Insisting on

fairness and good treatment of workers by the threat of tariffs seems to be a valid

way to use tariffs as a threat. Like protests, tariff threats should be used

only when necessary, rather than in every situation possible as Trump seems to

believe. To use both when unnecessary only serves to weaken their impact when they

are used when they are necessary.

References:

An

across-the-board tariff is not a trade policy, an across-the-board tariff is a

tax, says economist. Carl Weinberg. CNBC. Squawk Box. January 31, 2025. An

across-the-board tariff is not a trade policy, an across-the-board tariff is a

tax, says economist

Trump's

tariffs on Mexico, Canada, China would sock economy, lift inflation. Paul

Davidson, USA TODAY. February 1, 2025. Trump's

tariffs on Mexico, Canada, China would sock economy, lift inflation

From

avocados to autos, Trump tariffs on Canada and Mexico could hit close to home. Paul

Wiseman AP News. January 31, 2025. From

avocados to autos, Trump tariffs on Canada and Mexico could hit close to home |

AP News

What

Trump’s Trade War Would Mean, in Nine Charts. Shannon K. O'Neil and Julia Huesa.

Council on Foreign Relations. January 31. 2025. What

Trump’s Trade War Would Mean, in Nine Charts | Council on Foreign Relations

Zero-Sum

Tactics That Built Trump Inc. Could Backfire with World Leaders. Alisa Chang. Interview

with david Honig. July 4, 2018. Zero-Sum

Tactics That Built Trump Inc. Could Backfire With World Leaders : NPR

Graphic

Truth: Which major economy has the lowest tariffs? GZERO North. January 23,

2025. Graphic

Truth: Which major economy has the lowest tariffs? - GZERO Media

No comments:

Post a Comment