With the recent

world-class success of oil drilling offshore from neighboring Guyana, where 11

billion barrels of oil equivalent have been found, the small country of

Suriname is expected to drill successful wells on its Block 58. France’s TotalEnergies

and the U.S.’s APA Energy are partners in the project. The Suriname oil and gas

company Staatsolie has options to take 20% and is working towards doing that.

Big reserves to the southeast of Suriname, offshore Brazil, have also been

found.

Suriname is a

small country. It is multi-ethnic with many people of Indian, Chinese,

Indonesian, and African origins. As it was once a colony of the Netherlands,

Dutch is actually the main language spoken, at about 60%. The population is

also small at about 620,000, with most people living along the coast. Though

small, it is one of the least densely populated countries on Earth. The

interior consists of heavily forested mountains. That makes it one of the most forested

countries on Earth. Total emphasizes that they will use local labor for their project,

requiring as many as 6000 workers (200 direct and 4000 indirect). That is about

1% of the total population, although some will come from other places. They are

working with local universities to train people. The project will be the

biggest investment in the country's history.

TotalEnergies and

APA plan to develop the Sapakara and Krabdagu fields, renamed as "Gran

Morgu", with combined recoverable resources estimated above 700 million

barrels.

“A Floating Production Storage and Offloading (FPSO)

facility being built in Asia for the project, with a 200,000-barrel-per-day

capacity, is expected to be one of the company's largest”, Pouyanne said. That

contract, along with others including energy infrastructure builders SBM

Offshore and Saipem, represent a total of $7 billion, he added.

The plan is to

drill 32 wells. Half, or about 16 wells, will produce oil and the rest will

inject water and gas with oil. Gran Morgu is adjacent to Exxon’s prolific Stabroek

block in Guyana waters, where 11 million barrels of oil equivalent have been

booked. Total investment in the project is expected to be $10.5 billion. It is

a deep-water project with water depths ranging between 100 meters and 1000

meters. The area is approximately 150 km offshore. Exploration and appraisal

wells reveal estimated reserves of 750 million barrels equivalent on Block 58. Discoveries

have also been made by Malaysian company Petronas on adjacent Block 52, also in

Suriname’s waters.

“Over the estimated life of the production field,

Suriname will be benefitted with between $16bn and $26bn of net income

consisting of royalties, profit oil, and taxes.” At the high end that would

amount to generating about $42,000 for every person in the country! With other

potential projects also likely to be built as well, the country is on the verge

of becoming quite wealthy. Its debt problems of the past are likely to

disappear.

Total and APA

plan to utilize state-of-the-art mitigation of pollution and carbon emissions:

GranMorgu leverages technology to minimize greenhouse gas

emissions, with a scope 1 and 2 emissions intensity below 16 kg CO2e/boe thanks

in particular to:

- an all-electric FPSO configuration, with zero routine flaring and

full reinjection of associated gas into the reservoirs;

- an optimized power usage with a Waste Heat Recovery Unit and

optimized water cooling for improved efficiency;

- the installation of a permanent methane detection and monitoring

system relying on a network of sensors.

Suriname’s

government recently announced that they will not consider loans against the

future oil wealth, preferring to wait a few years until production is online. They

have established a sovereign wealth fund that will invest some of the future

wealth. The potential total wealth generated by the project at the high end is

five times the annual GDP of the country.

Guyana-Suriname Basin Geology

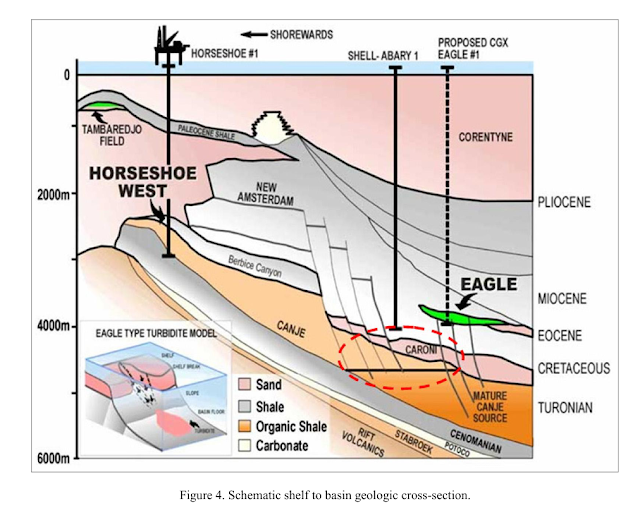

The geology of the Guyana-Suriname Basin is complex, but understanding has increased significantly in recent years. The hydrocarbon reservoirs are mainly Cretaceous and Tertiary in age. The Guyana-Suriname Basin is a half-graben Atlantic-margin basin. In 2000, the USGS rated it as the second most prospective unexplored sedimentary basin in the world. Basin floor fans, shelf margin deposits and turbidites directly overlie mature source rocks, the prolific Canje source kitchen that cooked hydrocarbons all over the region including equivalent source rocks in Venezuela and Columbia. The Canje section here is about 150 meters thick. Mature source rocks, stratigraphic closures, adequate geopressure, and effective lithologic seals, make the basin a hydrocarbon powerhouse. As can be seen, many earlier exploration efforts in shallower waters closer to shore resulted in dry holes. These wells were mainly down-dip and further from the source rocks.

The basin began

as a failed rift arm in the late Jurassic period. The rifting is part of the same

rifting that pulled South America away from Africa as the two continents were

joined in a Pangea event at the time. Thus, some of its exploration features

are similar to the hydrocarbon plays off of the coast of West Africa, but with

different sources of sedimentary rocks deposited.

Drilling offshore Guyana, Suriname, and French

Guiana in the 2000s and early 2010s confirmed the presence of the source rocks

and hydrocarbon shows but no production was established. A 2021 article in

World Oil by Endeavor Management recounts the drilling history of the offshore basin,

noting that knowledge and ideas from the deepwater West African plays began to

be incorporated:

“Reservoirs were predominantly slope-channel sands, known

as turbidites. Trapping style is referred to as stratigraphic traps, relying on

solid top and lateral seals (shales). Structural traps are rare. Oil companies

discovered early on, by drilling dry holes, that they needed to discriminate

the seismic response of hydrocarbon-bearing sands from wet sands. Each oil

company keeps its technological expertise concerning how they apply this

technology as confidential. Each subsequent well is used to tweak this

methodology. Once proven, this methodology significantly reduces the risk

associated with drilling appraisal and development wells and new prospects.”

Reservoir rocks

are mainly Tertiary and especially Cretaceous turbidite sandstones but

carbonate rocks and older Jurassic sandstones may be prospective as well.

A structural and

tectonic analysis of the Guyana Basin was published in April 2022 by the Geological

Society of London. The authors noted that multiple plate margins were present

due to the Pangea configuration that was about to split back up with rifting. The

abstract of the paper is below:

“The Guyana Basin formed during the Jurassic opening of

the North Atlantic. The basin margins vary in tectonic origin and include the

passive extensional volcanic margin of the Demerara Plateau in Suriname, an

oblique extensional margin inboard at the Guyana–Suriname border, a transform

margin parallel to the shelf in NW Guyana, and an ocean–ocean margin to the NE,

which morphed from transform to oblique extension. Plate reconstructions

suggest rifting and early seafloor spreading began with NNW/SSE extension (c.

190–160 Ma) but relative plate motion later changed to NW/SE. The fraction of

magmatic basin floor decreases westwards and the transition from continental to

oceanic crust narrows from 200 km in Suriname to less than 50 km in Guyana. The

geometry and position of the onshore Takutu Graben suggest it formed a failed

arm of a Jurassic triple junction that likely captured the Berbice river during

post-rift subsidence and funneled sediment into the Guyana Basin. Berriasian to

Aptian shortening caused crustal-scale folds and thrusts in the NE margin of

the basin along with minor inversions of basin margin and basin-segmenting

faults. Stratigraphically trapped Liza trend hydrocarbon discoveries are

located outboard of inverted basement faults, suggesting a link between

transform margin structure and their formation.”

The paper gives

nine seismic lines and their interpretations. The locations are shown below as

well as some other relevant maps and sections from the paper. The two seismic

lines and interpretations cross the currently productive parts of the basin. The

paper also notes a triple junction of three tectonic plates and a modern-day

analog being the Afar triple junction of the Arabian, Somali, and Nubian tectonic

plates along the east coast of North Africa.

References:

TotalEnergies,

APA greenlight $10.5 billion oil and gas project in Suriname. Ank Kuipers and Marianna Parraga.

Reuters. October 1, 2024. TotalEnergies,

APA greenlight $10.5 billion oil and gas project in Suriname

TotalEnergies,

APA to make investment decision in Suriname in Q4. Reuters. June 5, 2024. TotalEnergies,

APA to make investment decision in Suriname in Q4 | Reuters

GranMorgu

Project, Suriname. NS Energy.October 25, 2024. GranMorgu

Project, Suriname

The

Guyana-Suriname Basin: An Evolving Exploration Opportunity. Warren Workman and

David J. Birnie. AAPG Search and Discovery Article #10730 (2015). Posted March

20, 2015. The

Guyana-Suriname Basin: An Evolving Exploration Opportunity, #10730 (2015).

Guyana-Suriname

basin: Rise from obscurity to super potential. Thomas Cool and Lumay Viloria -

Endeavor Management. World Oil, May 2021. Guyana-Suriname-Oil-History.pdf

Geo-Expro

explores potential, challenges in Guyana-Suriname Basin in new report. Oil Now.

September 3, 2023. Geo-Expro

explores potential, challenges in Guyana-Suriname Basin in new report | OilNOW

The

structure and tectonics of the Guyana Basin. James Trude, Bill Kilsdonk, Tim

Grow, and Bryan Ott. The Lyell Collection. Geological Society London, Special Publications.

April 6, 2022. The

structure and tectonics of the Guyana Basin | Geological Society, London,

Special Publications

Suriname

will not consider loan offers against $26 billion oil patch. Ezra Fieser and

Jorgelina do Rosario, Bloomberg, World Oil. October 25, 2024. Suriname

will not consider loan offers against $26 billion oil patch

Suriname:

TotalEnergies announces Final Investment Decision for the GranMorgu development

on Block 58. TotalEnergies. Press Release. October 1, 2024. Suriname:

TotalEnergies announces Final Investment Decision for the GranMorgu development

on Block 58 | TotalEnergies.com

Suriname.

Wikipedia. Suriname -

Wikipedia

No comments:

Post a Comment