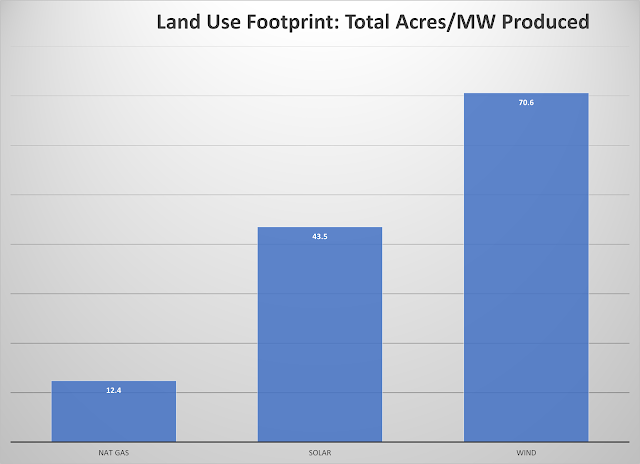

Wind and solar are energy sources with low power density.

Natural gas has a much higher power density and nuclear has a phenomenally high

power density. Low power density translates to higher land footprint. The land

footprint of solar per MW produced is nearly 4 times that of natural gas and

the land footprint of wind per MW produced is nearly 6 times that of natural

gas. Energy writer Robert Bryce describes the issue of power density in what he

calls the Iron Law of Power Density: the lower the power density the higher

the resource intensity.

Fig. 1 Land Use Footprint: Total Acres/MW Produced. Source: adapted from the Strata Group at Utah State University, June 2017.

Rare Earth elements (REE) mining, processing, and the making

of neodymium-iron-boron (Nd-Fe-B) magnets required for EVs and wind turbines is

dominated by China, a monopoly that will be difficult and take time to break

up. REE mining is now less dependent on China as more countries including the

US ramp up domestic mining – the US is now at 16% of REE mining globally, 0% of

processing, and 1% of Nd-Fe-B magnet production. However, China does 89-90% of processing

(separating and refining) and 92% of the making and doping (with other REEs) of

Nd-Fe-B magnets globally. So-called energy security could be compromised if we become

too dependent on China as Europe became too dependent on Russian gas. While I don’t

believe China will behave as Russia has, it is still a vulnerability and a risk

worth considering.

The US has

indeed stepped-up domestic mining of lithium, REEs, and critical minerals and

plans to increase processing at some point. This will not happen quickly.

Mining is often beset with permit delays due to environmental assessments,

public backlash, and supply chain issues. REE recycling is also occurring and affecting

smaller REE users. REE’s used in the IPhone 14 are reputed to be 98% from recycled

REE’s.

Robert Bryce, in a recent podcast with mining expert Simon Michaux, who noted that copper ores are becoming less concentrated, meaning that much more ore must be mined to get a similar amount of copper. Copper is a key resource for the energy transition, including for needed grid upgrades. Indeed, he noted that for electrification, basically for wires, copper is the key mineral. He suggested that for accelerated decarbonization the amount of copper mined might need to double every 4 or perhaps 5 years. Lower grade copper ore quality also means that more energy will be expended in processing that ore, more water will be needed to process it, and the whole process will get more expensive. Thus, it is certainly not likely that grid upgrade demands can be met in a reasonable time frame. In Chile the new leftist government has rejected a $2.5 billion copper and iron mining project on environmental grounds, citing harm to wildlife, water resources, air quality, and marine-protected areas. The project was sited near ecological reserves and has been debated for some time. Conservatives in the country were in favor of the project. It had already gone through the courts so is unlikely to resurface. President Gabriel Boric is following through on his pledge of ‘climate before profit.’ Chile is the world’s largest copper producer so this decision could have impacts on copper supplies. Meanwhile in Peru, the world's 2nd largest copper producer, there is political turmoil and the Antapaccay copper mine, the country's largest, has ceased operations temporarily after multiple attacks by protestors. The mine “was operating at a "restricted" capacity due to the protests, the company said earlier this week. The mine has been unable to transport supplies to its facility due to the blockades since Jan. 4, with only 38% of its workforce in place.”

“Glencore added that the transport of mineral

concentrates remains temporarily suspended.”

Lithium prices

remain highly elevated at five times what they were in 2019 through 1st half of

2021. This is certainly affecting battery and EV prices and is likely to

continue to have an effect until new supplies catch up with demand, which may

not happen. Other critical minerals like nickel, cobalt, and aluminum also shot

up in early 2022. They dropped later in the year but are still up above 2019-2020

levels. Copper prices rose in 2020 and are near those levels today. All of

these metals are in demand for the energy transition and if that transition is

accelerated, they are bound to rise further as lithium has done.

The bottom

line of this post is that even if we decide to accelerate decarbonization it

still may not happen. With high critical minerals prices reacting to growing

demand, every project will incur higher expense. With regulatory requirements and

public opposition to mining and processing, every project will face timing

delays. Regulatory delays and public opposition to wind, solar, and

transmission buildout projects will also likely delay them. Time sensitive mandates

and pledges mean nothing if they cannot be implemented.

Fig. 2 Lithium Carbonate Prices Remain 5 times what they were in 2019-through 1H 2021. Source: Trading Economics. Lithium - 2023 Data - 2017-2022 Historical - 2024 Forecast - Price - Quote - Chart (tradingeconomics.com)

References:

The Power of Power

Density. Robert Bryce. January 21, 2022. Youtube. The

Power of Power Density - Bing video

The Footprint of Energy.

Land Use of US Electricity Production. Strata. Utah State University. June 2017.

Strata:

the Footprint of Energy: Land Use of U.S. Electricity Production - DocsLib

Swedish rare earths

won’t dent China’s monopoly for decades. Robert Bryce. January 15, 2023. Substack.

Swedish

rare earths won’t dent China’s monopoly for decades (substack.com)

Chile rejects Andes

Iron's $2.5 billion Dominga mining project. Reuters. January 18, 2023. Chile

rejects Andes Iron's $2.5 billion Dominga mining project | Reuters

Glencore copper mine in Peru suspends operations after another attack. Reuters. Jan. 20, 2023. Glencore copper mine in Peru suspends operations after another attack | Reuters

The Power Hungry Podcast: Simon Michaux. Robert Bryce. The Power Hungry Podcast: Simon Michaux: Associate Professor of Geometallurgy at the Geological Survey of Finland on Apple Podcasts

No comments:

Post a Comment