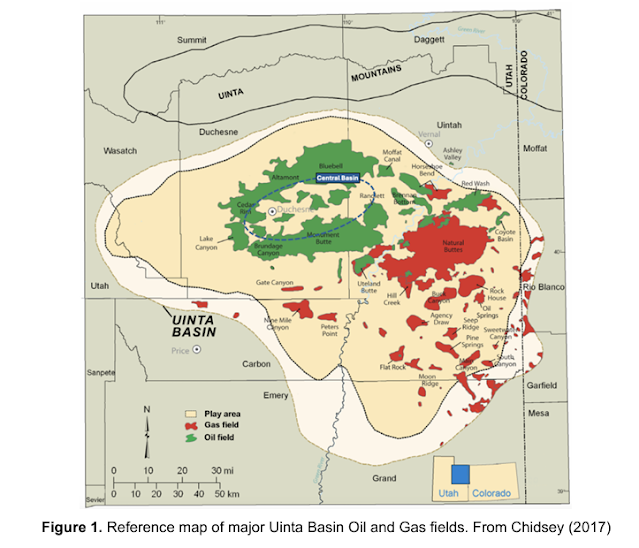

Uinta Basin Geology

The Uinta Basin

is a lacustrine, or inland sea/lake, basin. It had periods of freshwater influx

and saltwater influx. It is rich in organic matter and much of it is thermally

mature. There is no thrusting as in some nearby basins in the Rockies. There is

tectonic extension, particularly in the western part of the basin. Uinta Basin

oil & gas targets are shown in the stratigraphy section below. The Eocene

and Paleocene Epoch targets of the Paleogene, or older portion, of the Tertiary

Period of the Cenozoic Era are the reservoirs currently being drilled for

horizontal oil production.

Drilling began in

earnest in the Uinta basin in the early 1950s after a 1948 discovery well. Much of

the basin’s acreage is now held by production from the extensive vertical

drilling in the basin, much of it targeting the Green River formation

sandstones.

A study by Joshua

Sigler, Lucas Fidler, and Ted Cross presented at the Unconventional Resources

Technology Conference (URTeC) in June 2024 applied machine learning to examine

the plays. The machine learning model was trained to predict per-well gas, oil,

and water production. The abstract notes:

“…a machine learning (ML) model was employed to provide a

data-driven assessment of variable importance and relationships with production.”

“Our analysis

identifies operator-controlled variables such as proppant intensity as most important

for the Uteland Butte, and geological variables such as pressure as most

important for the Castle Peak. Comparatively, the basin's productivity aligns

closely with that of the Delaware and Williston Basins, indicating its

competitive stature in the unconventional oil play landscape. Expected

long-term development density ranks above the Williston but slightly below the Permian.”

“With a

lacustrine depositional environment and waxy crude, the Uinta Basin is distinct

from the typical marine environments and high-API crude found in the other

North American resource basins. However, the emerging Lower Green River-Wasatch

play demonstrates the successful cross-application of the “unconventional

playbook” of extended laterals, intense completions, and cube-style

developments to this novel setting. This study provides the groundwork to understand

this exciting new play and contextualize the impact of development designs in

this setting. With new zones to explore vertically and lateral expansion away

from existing developments, the Uinta basin has immense potential left to be

explored.”

More from the paper:

“By the late Paleocene, the foreland of NE Utah had been

sufficiently partitioned that a large freshwater lake, known as Lake Uinta, had

formed and became a thriving habitat for freshwater mollusks of the lacustrine Flagstaff

Formation (Picard, 1985). The dominant lithologic unit of the earliest Eocene throughout

much of the Uinta Basin are fluvial-delataic sandstones of the Wasatch

Formation, suggesting that Lake Uinta had contracted significantly by this time.”

“The Green River Formation is a variable assemblage of

intracratonic sedimentary deposits ranging from lacustrine carbonates and

TOC-rich shales in the deep subsurface to oolitic grainstones and

fluvial-deltaic sandstones at the southern margin of the basin.”

“As of this writing, 610 horizontal wells have been

drilled in the Central Basin, with 57% drilled in the last 4 years alone. At

least 9 different horizontal target benches within the Lower Green River and

Wasatch Formations have proven to deliver economically-viable production in the

Central Basin, giving operators numerous strategies to capture in-place

resources. Despite the numerous development configurations tested by operators,

virtually all projects focus on producing the Uteland Butte member (Uteland

Butte) and Upper Castle Peak member (Castle Peak) of the Lower Green River

Formation due to their high productivity and consistent performance.”

Dominant porosity

systems for each section of the basin and total organic carbon (TOC) are shown

below, followed by a graph comparing the Uinta Basin to other basins, the horizontal cumulative oil production history, cumulative well counts, and the conclusions

of the paper.

Conclusions

● Unconventional

oil plays in the Uinta Basin of northeastern Utah demonstrate rapid production

growth and comparable well performance to established basins such as the Permian

and Williston, despite a lacustrine depositional setting and waxy crude.

● Utilization of

an integrated data approach and machine learning model facilitated analysis of

geological properties, operator-controlled production drivers, and cross-basin comparisons.

● Our machine learning models, taking a statistical

approach only, matched already-published geologic analysis, such as the sonic

slowness cutoff for identifying organic porosity in the Uteland Butte.

● Our findings suggest that certain areas of the Uinta

Basin could achieve development densities and oil production performance on par

with the Permian Basin, attributed to a similar responsiveness to intensive

completions and the presence of thousands of feet of stacked pay zones

Hart Energy’s Super DUG Conference email advert noted the

following regarding SM Energy's Uinta Basin wells:

“SM Energy has joined the hotter-than-ever western Uinta

Basin oil play that’s been cut loose from a Salt Lake City-only refining

destination to loading at in-basin rail terminals, destined for anxious buyers

in Oklahoma and the Gulf Coast. Just a few months in, SM already has 18 new

wells in the play, with some of them testing the shallower of 17 oil payzones

while it has one test underway in the deepest in addition to landing in the

traditional money pot: the middle zones.”

A recent Hart Energy

webinar moderated by Nissa Darbonne featured Juan Nevarez, EVP, Scout Energy

Partners, and Riley Brinkerhoff, CEO, Duchesne River Resources. The slides below

are from that webinar. The speakers noted that the Uteland Butte member in the

Green River Formation is the main horizontal target and the biggest producer. The

many vertical wells drilled in the basin, a significant number of them

penetrating the pay intervals, allow geologists to map the play in detail. Rock

quality has been shown to be consistent over a large area for some targets.

Oil Quality, Refining Capacity, Transport Options, and

Other Issues

Most of the oil

in the Uinta Basin is a waxy crude or a crude oil high in paraffin content.

This makes it very difficult to transport via pipeline. It must be heated in

order to transport it. It can also be cracked and mixed with other crude for

transport but that can be so problematic that it isn’t being done. It is

typically trucked to refineries in Salt Lake City, typically two to three hours

away. Salt Lake City refineries had upped their capacity in recent years to

200,000 Bbls/day from the previous 90,000 Bbl/day. It is very unlikely that any

more refinery capacity would be available in Salt Lake City due to the weather

inversions in the region which can create very significant smog from the refinery

emissions. Rail transport is considered the best option for further transport

to the Gulf Coast where it is desirable for mixing with Permian light oil for

refining there. Transport costs are high due to the need to keep it warm. If it

cools and the wax becomes less mobile it becomes more problematic and more expensive

to reheat. The associated gas that is produced in the basin, especially in some

parts of the basin that have less gas pipeline takeaway capacity, is burned to

keep the oil warm. Other uses for the stray gas are power pumping units, gas-fueled

drilling rigs, and a few Bitcoin mining ventures. More gathering and local gas pipelines

are being built. The gas-to-oil ratio (GOR) for the basin is lower than many of

the shale basins including the Permian so the associated gas production is not

expected to grow significantly, especially as local uses for any stray gas are employed.

Oil quality, of

course, varies by the thermal maturity of each zone. The oil generally varies from

black waxy crude at about 32 API, to 41 API in Uteland Butte and even higher

than that in Wasatch. The black wax and yellow wax variants have basically the

same economic value. Currently, the differential is $18 lower than WTI but

would come down considerably with more volumes moving to the Gulf Coast.

The Uinta Basin

overlaps both federally owned land and tribally owned land of the Ute Tribe.

The Utes have been pro-oil and gas for a long time and operate many oil &

gas service companies in the area. Utah has been an oil & gas friendly state

with fast permit times and one of the most favorable regulatory environments in

the U.S.

Porosity Zone Types and Future Play Potential

Most deals in the

future will likely focus on the margins of the plays where there is more unleased

acreage but also higher risk. The mature window boundary in the south may move

further south in Upper Cube – Lower Douglass. Below that in the Castle Peak formation, the play is clastics and organic porosity in the limestone. Lots of undrilled

section is left to be determined if economic. The Garden Gulch is rapidly

becoming economical. More plays that don’t include organic porosity are likely

as there is a lot of oil-in-place south of the organic porosity window. There are 12

other intervals that don’t include organic porosity but dolomite porosity, clastics,

and carbonate porosity. The south part of the play is lower temperature and pressure,

so requires lower mud weights to drill and also does not require intermediate

casing as the northern areas do. The organic porosity zones are more continuous

and thus generally more amenable to longer laterals. U-laterals can be executed

in the play but are not needed except in cases of acreage limitations which is

rarer here than in say the Midland Basin Permian. The organic porosity zone plays

do not require seismic in general but the fluvial-deltaic clastics do require seismic

to assess their continuity. There are publicly available 3D seismic shoots in

the basin.

Production Issues

The different

zones are still being evaluated for frac optimization with frac parameters such

as stage spacing and sand loading being tweaked up or down to find the right

recipes. The temperature and pressure are higher in the north part of the basin

which means higher mud weights are required for drilling there.

Stress variation

due to extensional fracturing, particularly in the western part of the basin.

The many joint sets lead to more fluid movement including water. Leak-off from

permeable sandstones a problem where many verticals drilled. Water production

is pretty high in the Uinta but varies by area and type of frac. Bigger fracs

have meant more water production. 50% water cut is the basic average. Uteland Butte

is as high as 70% water cut in clastics from the upper cube. Much of the water

production is reused for fracs. Much is re-injected into the Uinta Formation above

the oil pay zones in the Green River formation. Water issues are one aspect of

reservoir management that will be important to optimizing the play and

preventing unexpected problems as time goes on.

References:

Unpacking

the Uinta Basin: the next great oil play? Joshua Sigler, Lucas Fidler, Ted

Cross. XCL Resources, Novi Labs. Unconventional Resources Technology

Conference. June 2024. Uinta.pdf

SM’s

First 18 Uinta Wells Outproducing Industry-Wide Midland, South Texas Results. Nissa

Darbonne. Hart Energy. February 20, 2025. SM’s First 18 Uinta Wells

Outproducing Industry-Wide Midland, South Texas Results | Hart Energy

Hot in

Utah: Uinta Basin Oil Output Unleashed. Hart Energy Webinar. February 26, 2025.

Hart

Energy Webinar | Hot in Utah: Uinta Basin Oil Output Unleashed

Slide

Set from Webinar. Hart

Energy Webinars 02-26-25 Hot in Utah_Uinta Basin Oil Output

Unleashed_Presentation Slides.pdf

Major

Oil Plays in Utah and Vicinity. Thomas C. Chidsey, Jr. Utah Geological Survey. January

2010. Major

Oil Plays in Utah and Vicinity - Utah Geological Survey

Oil

and Gas in the Uinta Basin, Utah – What to do with the Produced Water. Thomas

C. Chidsey, Jr., May 2018. Utah Geological Survey. Oil

and Gas in the Uinta Basin, Utah – What to Do with the Produced Water - Utah

Geological Survey

No comments:

Post a Comment