While stranded asset concerns have

long been touted by environmentalists who erroneously think we are somehow on

the verge of eliminating fossil fuel use, the facts do not support such a

conclusion. Alternative energy sources are not yet even keeping up with demand

growth, although they have been getting closer. However, when such issues are

examined on a regional basis, there may be some legitimate concerns.

A

new report from the UK: Stranding: Modelling the UK’s Exposure to

At-Risk Fossil Fuel Assets by the UK Sustainable Investment and

Finance Association reports that in order to meet decarbonization pathway

goals, some fossil fuel assets risk becoming stranded in the UK. Of course, the

report assumes that those pathway targets will be able to be met, by utilizing

technologies like offshore wind, which have become more expensive in recent

years. The report seems to focus on the goal of staying below 1.5 degrees C,

which may have never really been technically possible. It’s all but certain that

the 1.5 deg C goal will not be met. They calculate $2.28 trillion in global

losses due to stranded assets by 2040 and $141 billion of UK exposure to

possible strandings. The list below of how assets may become stranded is

telling. The first one given, climate policies and regulations, can be seen as

self-imposed limitations on something in high demand. Second, the notion that

fossil fuel infrastructure will become uneconomical due again to emissions

regulations and also declining demand, is both self-imposed and unlikely in the

near-term demand is still robust. Thirdly, advances in solar, wind, and battery

technologies can help them be more competitive, but no big breakthroughs are

appearing on the horizon at present. Fourth, the idea that it will become

uneconomical to drill for hydrocarbons, is also not going to happen in the

foreseeable future due to robust demand. Fifth is the idea that consumers will

demand more renewable energy and less fossil fuels. This is another hope that

does not seem realistic anytime soon. Sixth, are legal and reputational risks,

more self-imposed regulatory control. I think it was the CEO of Duke Energy who

once said that all technologies have stranded asset risks and that these were

more manageable than often depicted. There are ways to reuse, repurpose, and

more likely to write down such assets. Devices like securitization bonds can be

employed.

Unfortunately,

stranded asset risks have been used as a tool of influence to discourage and

scrutinize fossil fuel investments. This should not be used for controlling

financing decisions, especially for projects in developing countries where

affordable modern energy access is more important than emissions.

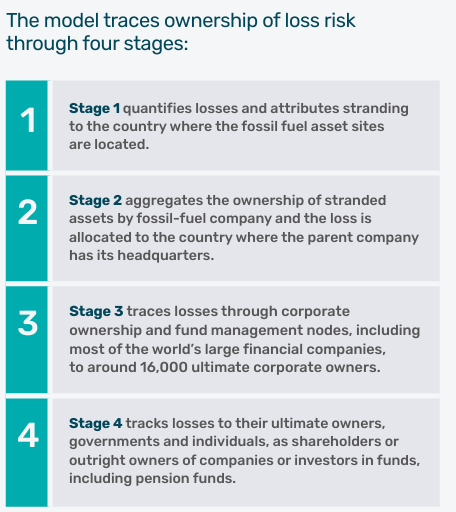

Below

is a depiction of something called the FRANTIC model of four stages of asset

stranding that was used in the report.

As

can be seen in the graph below, the U.S. and Russia are most exposed to

stranded assets according to the report. This is no doubt due to the

well-developed oil & gas industries in both countries, including exports.

The 2nd graph below shows liabilities by regional owners, whether governments,

corporate entities, financers, individuals, fund owners, or others.

The

whole notion of stranding assets through regulation is self-imposed, as I

noted. It does not consider market conditions and supply and demand issues. It

also does not consider power reliability. There is a robust demand for natural

gas around the world. There is also an abundant supply of natural gas. It aids

power reliability. Most future power models, including sufficiently

decarbonized models, show increased use of natural gas in the near term. At

some point later, probably beyond 2035, demand may drop, if other technologies

are more competitive.

The

report gives four recommendations:

1. Create

positive, enabling conditions for decarbonising investment opportunities

2. Industrial

decarbonisation strategies

3. A

clear regulatory framework to support sustainable finance and transition

finance, including robust transition planning

4. UK

leadership on investor stewardship should be further cemented and continue to

evolve, including accounting for systemic stewardship approaches

The

report cites Bloomberg New Energy Finance that total global energy investment

and spending from 2024 to 2050 will be between $181 trillion and $215 trillion.

The report also notes the lack of detail in corporate energy transition plans.

That, I believe, is necessitated by the unknown cost and the generally high

cost and low profitability of clean energy investments. They want to address

the issue with a regulatory framework for energy transition financing. As

always, I prefer the carrot approach over the stick approach as does the

private sector. The report favors a regulatory approach to decarbonization, a

stick approach. I think that the best way to get more private sector approval

is to focus on carrot approaches like voluntary market mechanisms, tax credits,

and subsidies. Subsidization is a necessary carrot approach to make low-carbon

energy more competitive but shooting yourself in the foot by using stick

approaches to make fossil fuels more expensive when they are clearly in heavy

demand is just not smart. Oil demand is expected to plateau around 2030, says

the IEA, but the IEA does not have the greatest predictive record. It could

plateau for a decade. Any talk of the death of fossil fuels is greatly

exaggerated at best and delusional at worst.

References:

New

analysis predicts that $2.3 trillion worth of assets could be 'stranded' by

2035 — here's what that means. Beth Newhart. The Cool Down. March 24, 2025. New

analysis predicts that $2.3 trillion worth of assets could be 'stranded' by

2035 — here's what that means

Stranding:

Modelling the UK’s Exposure to At-Risk Fossil Fuel Assets. UK Sustainable

Investment and Finance Association. March 2025. UKSIF-Stranded-Assets-Report-March-2025.pdf