Arbitrage

refers to the practice of buying low and selling high. In the context of energy

storage, it means charging batteries when energy prices and demand are low and

discharging them when prices and demand are high. This is one way that

batteries can help offset their high upfront costs. Dynamic energy pricing has

resulted from the changing availability of resources during daily cycles and

seasonal cycles, mostly with variable generation such as solar and wind.

Natural gas can have some changing availability in high-demand times due to

pipeline constraints. Solar and wind variability are predictable enough that dynamic

pricing can be supported. This allows battery owners to charge low and sell

high. The EIA gives the following definition for arbitrage: “The

simultaneous purchase and sale of identical or similar assets across two or

more markets in order to profit from a temporary price discrepancy.” The

key here is “the ability to profit.”

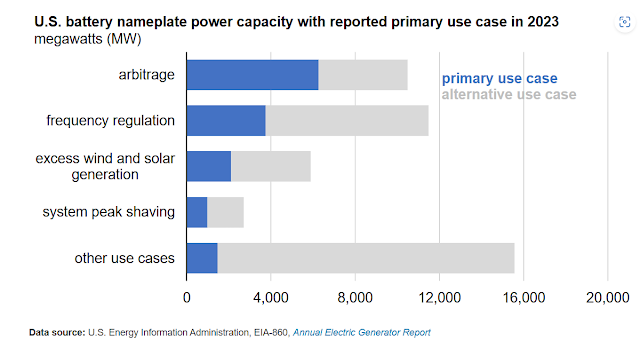

EIA reports

that as of the end of 2023, U.S. utilities operate 575 batteries with a

collective capacity of 15,814 megawatts (MW). This is expected to possibly triple

by 2028 if all proposed projects get built. The data from the graph below comes

from a preliminary release of EIA’s Annual Electric Generator Report.

To recap, the main uses of grid-scale batteries, chiefly

lithium batteries, is in arbitrage, providing grid stability through ancillary

services such as frequency regulation and demand response services peak shaving,

and in storing excess wind and solar generation.

References:

Utilities

report batteries are most commonly used for arbitrage and grid stability.

Energy Information Administration. Today in Energy. June 25, 2024. Utilities

report batteries are most commonly used for arbitrage and grid stability - U.S.

Energy Information Administration (EIA)

No comments:

Post a Comment