Hydrogen Demand and Production

The current global

demand for hydrogen for 2022 is at 95 MT, a 5% increase from 2020. Expected H2

demand in 2030 is 115 MT, a 3-3.5% increase per annum. Decarbonization models

hope for a 5-6% increase per annum to 2030 so it could end up a little higher. While

that is a substantial increase from present, it is hardly a “boom.” Even stretching

out to 2050 hydrogen may double or triple what it is now but that is not a huge

yearly increase. The main reasobn it won’t grow faster is cost. Although many

projects have been announced few have reached final investment decisions

(FIDs). The graph below from 2020-2021 shows the amount of hydrogen production from

different sources. The difference between production and demand reflects that

some hydrogen is stored underground and in pipelines. Current hydrogen with CCS,

aka. blue hydrogen, is less than 1% of hydrogen production. Current green

hydrogen production is closer to 0.3% of hydrogen production. Currently, 26

countries have national hydrogen strategies.

Hydrogen in Refining, Petrochemicals, Industry, and

Transport

The biggest

users of hydrogen by far are the oil refining and chemicals sectors. Hydrogen

is used in the refining sector mainly for desulfurization, for hydrogenating aromatics

and olefins, and for hydrocracking heavier hydrocarbon molecules into lighter

ones in the gasoline range. Currently, North America and China have the highest

use of hydrogen in refineries followed distantly by the Middle East and Europe.

Oils with higher sulfur content require more hydrogen for processing. New

sulfur rules for fuels, including shipping fuel oils and gasoline, also add a

little to hydrogen demand. Hydrogen is typically made at refineries by steam methane

reforming. That process could be retrofitted to capture carbon. Refineries typically

have hydrogen pipelines in place within and between facilities. Hydrogen

pipelines are more costly and have more detailed specifications than natural

gas pipelines, but hydrogen can be blended with natural gas to a certain amount

and be transported in those gas pipelines without modification. However, most

hydrogen projects will want to optimize production near to where it is to be

used: at or near refineries, power plants, or underground or tank storage

fields.

In industry the

biggest use of hydrogen is as a feedstock for ammonia in fertilizer plants. The

second biggest use is as a feedstock for methanol. A new use for hydrogen in

low emissions steelmaking is direct-reduced iron (DRI) powered by electric arc

furnaces. If the hydrogen is green hydrogen and the electricity for the arc

furnace is provided by renewables as well, the process will have the lowest

emissions. It may also utilize blue hydrogen and standard grid power for less

emissions reduction. DRI already takes up about 10% of industrial hydrogen for related

processes. Blending hydrogen with natural gas and coal combustion can also

lower emissions in existing steelmaking.

Hydrogen use

in road transport doubled from 2019 to 2021. Its use is predominantly in buses

and commercial transport, although its use in cars also doubled. The first hydrogen

fuel cell train fleet (14 trains) was deployed in August 2022 in Lower Saxony,

Germany. The stock of fuel cell electric vehicles, mostly cars, has tripled in

less than 4 years. China, Europe, and Japan are leading in hydrogen for

transport and hydrogen road fueling infrastructure. Hydrogen, methanol, and

ammonia are also being used in rail, cargo handling, and shipping. Its use at

ports helps to lower heavy port air pollution. Methanol, followed by ammonia,

then hydrogen is the most developed shipping fuel so far. Methanol is a liquid

at room temperature and is less toxic than ammonia. However, ammonia has been

shipped at significant levels as fertilizer feedstock for many years.

Other uses for

fuel cells are in buildings and as stationary power sources. There are plans to

add more hydrogen capacity at power plants mostly to run combined-cycle gas

turbines either blended with natural gas or eventually as standalone hydrogen

sources. Blends with ammonia have also been announced. Europe and Asia, mostly

Japan and South Korea, are expected to lead here. The IEA estimates that global

capacity for hydrogen and ammonia for power production will reach about 1.4 GW

by 2030.

Blue Hydrogen (w/CCS) and Green Hydrogen Projections

(IEA)

If all

announced projects are delivered and delivered on time, then blue hydrogen could

increase by 10 MT and green hydrogen could increase by 14 MT by 2030. I would

say that this goal is aspirational and unlikely since only 4% of those projects

are either under construction or have reached FID. It would require blue

hydrogen to grow by 10 times in 80 months and green hydrogen to grow by well

over 40 times in those same 80 months. That does not seem likely at all,

especially the green hydrogen scenario which is much more costly per kg of H2.

I really don’t expect any major ramp-up of hydrogen till after 2030-2035.

Green hydrogen

will be the favored form of hydrogen in countries that import natural gas due

to lack of domestic supply. Those countries pay a higher cost for natural gas

so making hydrogen from it is uneconomic compared to countries with abundant domestic

supply that export their gas. The U.S. is well situated for blue hydrogen but

Europe is better situated for green hydrogen, made from water with

electrolyzers powered by renewable energy. Blue hydrogen from the U.S. and other

gas producing countries, including Norway, will be much cheaper to produce than

green hydrogen, 3 to 4 times cheaper. Blue hydrogen is dependent on the cost of

natural gas, which while volatile in 2022 has been steady in most years,

especially in places that are pipeline-constrained like Appalachia. Green hydrogen

is dependent on the cost of electricity as well as the output of wind and solar,

which can vary. China and the EU lead in electrolyzer capacity. The U.S. is

third. Japan has done much electrolyzer research but does not have a high

electrolyzer capacity. Current electrolyzer capacity is at 10GW but could grow

to 60-100GW by 2030. To get over 60GW capacity by 2030 will require strategic development

of manufacturing and supply chains. The IEA also suggests in a graph that the

cost of electrolyzers will drop by a half to two thirds by 2025. Like most of

their H2 predictions, I am quite skeptical. That is less than 2 years away. Electrolyzers

require nickel and platinum group minerals so the cost of those commodities

will be a factor.

Policy boosts

could help deployment of both pilot and commercial projects. Global standards need

to be developed as well as interoperability. Safety standards also need to be agreed.

Renewables will likely be sited with electrolyzers as dedicated generation

sources tied strictly to making hydrogen. They also have a high land footprint.

They will likely have to be overbuilt to some extent to keep the plants running

at full capacity, especially to account for daily and seasonal intermittency.

They may require some storage or even back-up fossil resources to keep up full utilization.

This is especially so of projects that hope to use clipped/curtailed renewables

to make hydrogen in those hours when they are overproducing. The economics of

those projects are affected by utilization rates that will be much lower than those

with dedicated generation. Using grid power to power electrolyzers is not

feasible in most cases as it could strain local power and likely require added

transmission.

Hydrogen Infrastructure, Trade, Byproducts, Storage,

and Sequential Development

Hydrogen pipelines

have more costly specs than natural gas pipelines. They need special materials

and compressors made for hydrogen which are more expensive and more energy

consuming than natural gas compressors. Hydrogen can increase the fatigue growth

rate of carbon steel pipelines and degrade pipelines faster through the process

of hydrogen embrittlement which makes the steel less ductile, more brittle, and

thus more likely to crack. Things can be done to reduce that possibility but

add to costs. The possibility of transporting and trading hydrogen as a liquid

also requires many new logistical considerations. Hydrogen needs lower

temperatures to liquify it than does LNG. It also requires tanks that cost about

50% more than LNG tanks. Turning it into ammonia is an option which can use the

same tanks and piping, but the tank foundations need to be stronger and smaller

since ammonia is much heavier than hydrogen. Thus, there are investment risks

to making an LNG facility hydrogen-ready. Liquid hydrogen trade is in its

infancy. Currently Japan and Australia trade but that is it. It has been

estimated that H2 trade could reach 12 MT by 2030 but that seems unlikely.

There are potential customers for about 2 MT and another 2.5 MT possible. Shipping

routes, policy, and importing/exporting terminals need to be developed.

A useful

byproduct of green hydrogen production is pure oxygen which can be sold to

medical or chemical facilities or to power plants utilizing oxyfuel combustion to

optimize pre-combustion carbon capture, like those natural gas plants beginning

to be commercialized using the Allam Cycle.

Underground hydrogen

storage in salt caverns is well established in the U.S. Its storage in depleted

gas fields is still in the early stages as residual gas in the reservoir, chemical

reactions, and the movement of hydrogen through rock porosity have some unknowns.

It is likely that porous rock reservoirs, sealed aquifers, and hard rock caverns

can store hydrogen adequately. It should also be noted that underground storage

projects for gases take a long time to be approved and constructed.

I and many

others think that developing a blue hydrogen economy now where applicable will

help in developing a green hydrogen economy later when costs come down due to technology

improvements, economies of scope and scale, modularization, standardization,

and cheaper, simpler, and more streamlined permitting. However, the IEA

believes that the EU will go ahead with big green hydrogen ramp-up as soon as

they can. I am quite skeptical of their fast timeline. The blue to green sequence

will certainly work better and be more economically favorable in the U.S. and

Canada. They do acknowledge their upgraded timeline may be overly ambitious in

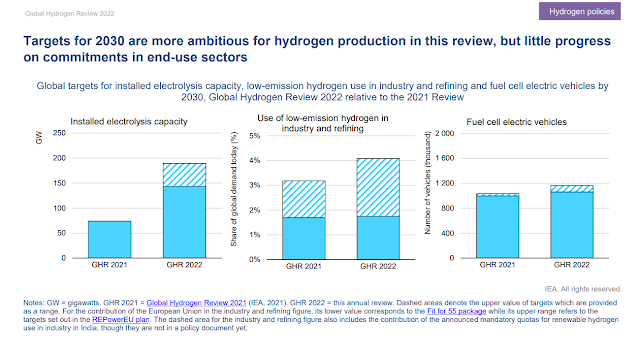

the following graph from their report which compares their 2021 projections to

2030 with their 2022 projections to 2030. One reason for the increase is the

energy crisis brought on by Russian sanctions and turning away from Russian

gas. However, the winter has stayed relatively warm and gas prices have

stabilized so perhaps they will slow down their predictions a bit next year.

Conclusions

While lower

emissions hydrogen in its blue and green forms will no doubt increase in

deployment the rate of that increase is questionable. The IAE’s ambitious

near-term forecasts, especially for green hydrogen do not seem obtainable to

me. However, I could be wrong as they have policies and subsidization in place

to help projects along. Others issues like manufacturing and supply chain

challenges don’t bode well for a fast rollout. There are other things still to

be worked out. I do think hydrogen will be a growing part of the energy picture

in years to come but how many years to come is the question. My guess is closer

to 2035 rather than 2030.

References:

The Outlook for

Hydrogen in an Evolving Energy Landscape (GTI Webinar, Feb. 3, 2023). Gas Technology

Institute.

Natural Gas and

Decarbonization: Key Component and Enabler of the Lower Carbon, Reasonable Cost

Energy Systems of the Future: Strategies for the 2020’s and Beyond. Kent C. Stewart.

March 2022. Amazon Publishing.

Global Hydrogen

Review 2022. International Energy Agency. Clean Energy Ministerial, Hydrogen

Initiative. Global

Hydrogen Review 2022 (windows.net)

No comments:

Post a Comment