The recent

Biden administration announcement to slow approvals of LNG projects over

climate impact concerns is probably unnecessary and should probably be reversed. Net impacts of

these projects will be less greenhouse gas emissions as LNG replaces coal in

the places where it is exported. Climate activists, including those in the

Biden administration like John Podesta, encouraged the slowdown and cheered the

decision. This is another political nod to the minority climate activist left and

validates Joe Manchin’s assertions that Biden is kowtowing to the far left. As Manchin

indicates, he would be better off politically giving such nods to the moderates

who are more likely to vote for his opponent rather than the leftists who would

more likely not vote at all or vote for a third party. While the slowdown is

likely to be temporary, it is not necessary. Delaying is the next best thing to

banning for radical environmentalists. It likely won't matter as the roughly 27 BCF/day of approved capacity is apparently not part of the pause as I now understand it. That essentially means that the pause will have little if any affect on LNG going forward.

The emissions

of these LNG projects, while considerable, are far less than those of the coal

plants they are helping to replace. This is true of the air pollution and water

pollution impacts as well. U.S. natural gas, particularly from the Haynesville

Shale and the Appalachian Shales is among the lowest emissions upstream natural

gas in the world, and midstream emissions reductions are catching up. These

projects also help the American economy by balancing trade in our favor and

putting Americans to work.

The biggest

impact could be to the Calcasieu Pass 2 (CP2) LNG project on the Louisiana Gulf

Coast which is hoped to export up to 20 million tons of LNG and is the largest

proposed project to date. These projects are needed to supply natural gas to

Europe, Asia, and South America. Delaying them would simply allow other

countries like Qatar to fill the void later when they can.

According to

CNN: “Shaylyn Hynes, a spokesperson for CP2’s owner Venture Global, said the

reported plans from the Biden administration would “create uncertainty about

whether our allies can rely on US LNG for their energy security” and would

“shock the global energy market.” Also, CNN: “That decision would be one

we would get behind; these LNG export projects have been rubber stamped up to

this point,” said Mahyar Sorour, the director of beyond fossil fuels policy at

the Sierra Club. “We’re encouraged.” Thus, we have yet another situation

where American companies are unnecessarily harmed, radical environmental groups

are unnecessarily appeased, and the environment and the climate would suffer

net negative impacts. These projects already must meet stringent emissions requirements,

and many are going further than the requirements, throughout the upstream to

downstream life cycle.

Less LNG Exports Mean More Coal Exports

The coal impacts are not only coming from Asia but from the U.S. as well. Reuters reported that during the first eight months of 2023 thermal coal, the kind used in power plants, exports from the U.S. increased to 22.5 million tonnes through August, up from 18.3 million in the same period in 2022. According to Reuters: “In percentage terms, the increase in U.S. exports was the largest among all major thermal coal exporters, surpassing even the 15.7% expansion seen from top coal exporter Indonesia.”

“The strong gains in U.S. coal exports contrast with

the declines seen in domestic coal use for power generation, with U.S.

coal-fired power production down over 50% since 2010 as part of efforts to

reduce national fossil-fuel emissions.”

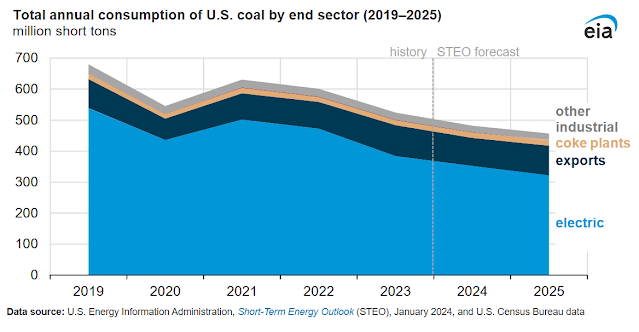

The EIA

reports that U.S. coal exports are now accounting for a larger share of the shrinking

U.S. coal market. Of course, it is also more emissions-intense to export coal

than to burn it here. EIA notes: “We expect that the U.S. electric power

sector will consume 73% of U.S. coal in 2024 and 70% in 2025, down from 79% in

2019. In 2019, the U.S. electric power sector consumed 539 MMst of coal, while

exports totaled 94 MMst.” These totals also include metallurgical coal but

the increases reflect thermal coal as metallurgical coal exports have remained

constant

If the Biden administration

wanted to halt something harmful it should have halted the many tens of millions

going to UNRWA in Gaza that was funding Hamas to buy, build, and smuggle

weapons and to prepare for and execute their brutal October 7 massacre. Granted,

they also provide food and aid to Gazans, so it is perhaps understandable in

that sense, but it has long been known that this particular UN group was

complicit with the terrorist group.

Addendum: Feb, 3, 2024.

According to Hart Energy's Gas & Midstream Weekly 32BCF/day of U.S. LNG Export Capacity has been approved but not yet built. They also note that of all the projects in the pipeline to 2030, only 5BCF is being paused by the Biden Administration. Thus, it seems as if this will not be as big a problem as it originally seemed since it is thought that some of the planned LNG projects in the later 2020s may not end up being built anyway. That means that about 27BCF/day has been approved, which would more than triple the current capacity. The amount affected by the pause, 5BCF/day, is just 15.6% of that 32 BCF in planning. (I wonder if that is an error since the graph below shows about 17BCF/day FID'd and/or approved along with the 5% unapproved, and the 32BCF total existing capacity. That would mean 29.4 % of planned capacity was under the pause. Even so, 17BCF/day of additional capacity may be enough.) I am doubtful that even all the approved capacity will be built. Thus, it appears the pause is not nearly as bad as it first appeared to be.

References:

Biden administration

considers overhaul of natural gas export approval process, throwing major Gulf

projects into question. Ella Nilsen. January 24, 2024. CNN. Biden

administration considers overhaul of natural gas export approval process,

throwing major Gulf projects into question (msn.com)

US thermal coal

exports jump to 5-year highs on Asian demand: Maguire. Gavin Maguire. Reuters. September

26, 2023. US

thermal coal exports jump to 5-year highs on Asian demand: Maguire | Reuters

U.S. coal exports

account for larger share of a shrinking market. Energy Information

Administration. January 29, 2024. U.S. coal exports

account for larger share of a shrinking market - U.S. Energy Information

Administration (EIA)

Hart Energy Gas & Midstream Weekly Newsletter. February 1, 2024.