Brine mining

refers to the extraction of minerals from brines by evaporation and/or precipitation

or by chemical, physical and/or electrical separation. Brine mining began with extracting

salt from seawater. Potassium is sometimes extracted from the bittern left over

from salt precipitation. The seawater bittern solution contains sodium, potassium,

magnesium, calcium, chloride, sulfide, iodide, and other ions that precipitate

out as compounds, as salts along with the sea salt. Bittern is one of the coagulants

used in the production of tofu. It is used in the treatment of some wastewater and

to make fertilizer. Epsom salts are another bittern precipitate. Desalination

plants process seawater to extract the salts.

The Chinese

began digging brine wells around 500 B.C., some over 330 ft deep. The wells

utilized salt-resistant bamboo for derricks, ropes, and casing. Iron wedges

pounded the bamboo into the ground by men jumping on a lever.

A January 2023

paper in Nature Water - Prospects of metal recovery from wastewater and

brine – did some technological and economic feasibility analyses of brine

and industrial wastewater mining. They concluded that initial concentrations of

the minerals in the brine and wastewaters and the cost of each mineral

commodity dictates viability. Thus, only certain brines and wastewater will be

prospective.

Saline Lakes, Shallow Groundwater Brines, Geothermal

Brines and Deep Brines in Sedimentary Basins

Brine is also

mined from saline lakes that have higher salinity and yield higher

concentrations of salts than seawater. The Dead Sea and the Great Salt Lake are

examples. Different saline lakes have different chemistries. Shallow

groundwater brines are associated with saline lakes or dried-up saline lakes.

Deeper geothermal brines may influence the chemistry of shallow groundwater

brines. Sodium sulfate, soda ash, salt, colloidal silica, boron, magnesium,

calcium, potassium, bromine, zinc, tungsten, and iodine are other extractable

minerals and compounds from saline lakes, shallow brines, and deeper geothermal

brines. The tables below show some of the main locations, sources, and concentrations

of mined brines.

Lithium Recovery from Ores and Brines

Lithium is produced

from lithium-rich rock from pegmatite deposits such as spodumene and from the

extraction of salts from subsurface brines. Some lithium is also expected to be

produced from clay. Lithium from rock ore is of higher concentration but is

more costly to produce because it requires digging out, crushing, heating, and

cooling. Lithium from shallow brines is concentrated through time in evaporated

ponds called salars in Chile, Argentina, and Bolivia in an area of the Andes

with very little rainfall. Brine is extracted from shallow wells and evaporated

in ponds on the surface to concentrate the mineral precipitates. When

concentrations reach suitable levels, the mineral salts are taken for further

processing. Now there are new methods to extract lithium and other minerals

from brines that do not require the very large evaporation ponds.

The economics

of lithium extraction depend on the concentrations of lithium in the brines and

ores, the cost of extraction, and the price of lithium. Lithium prices have

been high in recent years and demand is expected to stay robust in the years to

come as more EVs, grid-scale batteries, and lithium-powered products are built. The downsides of lithium extraction via solar evaporation ponds include the long

timelines (18 months), the large amount of required acreage, and the environmental

impacts.

Lithium is

further processed into metals. Via an electrolytic cell, lithium chloride (55%)

is mixed with potassium chloride (45%). This makes a molten eutectic electrolyte.

The combined chemicals increase the conductivity of the lithium and lower the

fusion temperature. When fused and electrolyzed at 840 deg F chlorine gas is

liberated, and molten lithium rises to the surface. It is collected in cast

iron and treated with paraffin to prevent oxidation. It takes about 5.3 times

as much lithium carbonate to make the same amount of lithium metal.

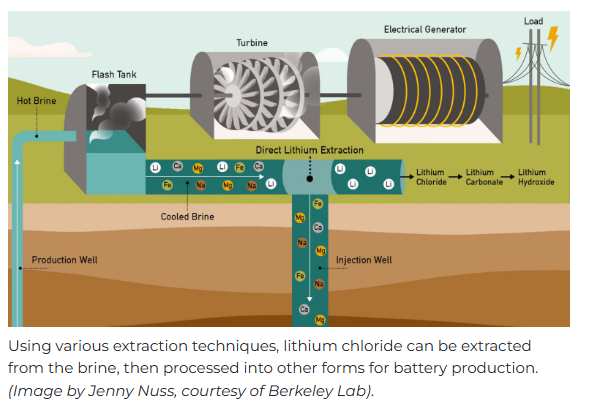

Direct Lithium Extraction (DLE) from Brines

The methods of

lithium production in the salars and solar evaporation ponds in South America

are not applicable to other places due to space requirements and environmental degradation. The South American high deserts are not populated,

have a low amount of flora and fauna, and much of the groundwater (the brine)

is already naturally contaminated and unsuitable for drinking. Direct lithium

extraction (DLE) has far less environmental impact and space requirements. The

DLE process relies on filters, membranes, ceramic beads, and other equipment to

extract lithium and other minerals. The post-extraction water is pumped into wastewater

injection wells nearby. The process resembles a wastewater treatment plant.

An article in

Civil Engineering Magazine describes it as follows: “Depending on a

particular brine’s geochemistry, various pretreatment steps are used to remove

solids, hydrogen sulfide, and other contaminants. Adsorption, ion exchange, and

solvent extraction are among the most common methods under development to

extract lithium directly from brine.” DLE methods are applicable as well to

the South American brines traditionally extracted with solar evaporation ponds

and offer a way for those companies to reduce their environmental footprint. Goldman

Sachs thinks DLE will be adopted in many of those operations in the 2025-2030

timeframe. Their market report from late April 2023 suggests that costs are

comparable between solar evaporation ponds and DLE. DLE requires higher upfront

costs but recovers much higher percentages of lithium. The ability to eliminate

many of the environmental downsides at comparable costs makes widespread

adoption likely.

A paper in Nature

Reviews Earth & Environment - Environmental impact of direct lithium

extraction from brines – noted that many environmental impact studies of

DLE thus far have not been performed on real brines. Thus, there may be some

pre-processing issues for different brine chemistries. Those often require heat

energy and have emissions. Environmental impact studies of DLE methods need to

consider the use of heat, pH adjustment, and other energy and water inputs when

doing a lifecycle analysis for each method. For instance, methods requiring

high water inputs would not be environmentally sound in arid areas. They would also

be less cost-effective.

There are

three main DLE methods in operation and two more in development. Those in operation

are adsorption, ion exchange, and solvent extraction. Those in development are membrane

separation and precipitants. High lithium demand and prices and new government

incentives for domestic critical minerals production in the U.S. have spurred

new pilot and production projects for DLE technologies.

Adsorption is

the most developed DLE method globally. This method is used in many other

industries as well. One of the advantages of adsorption is that it uses water to

yield lithium chloride and soda ash to yield lithium carbonate rather than using

reagents (acids). It produces less waste and is efficient as it extracts over

90% of the lithium. It does have high upfront costs, some process contamination

issues, can have high operating costs, and may require additional heat energy.

According to Goldman Sachs: “Ion exchange systems separate ionic contaminants from solution through a physicochemical process where undesirable ions are replaced by other ions of the same electrical charge. Essentially, the ion-exchange material acts as a sieve with an adjusted porosity that only allows lithium (and hydrogen) ions to pass through, where the ion-sieve can then be washed with an acidic solution promoting the replacement of lithium ions with hydrogen ions. Lithium recovery by ion exchange can change with a simple adjustment in pH, temperature, or stream composition (though the same goes for other lithium extraction methods), but researchers also believe this method can recover ~90% of the lithium present.” Several of the Salton Sea projects as well as Standard Lithium’s Smackover projects plan to use ion exchange DLE with some expected to commence operation in 2024. Advantages of ion exchange include simplicity of the process, low chance of process contamination, high capacity, ability to process low-concentration brines, low energy and water consumption, and likelihood of continuous operation. The downsides include high acid and base input requirements with accompanying risks, high upfront costs, and some components vulnerable to acid degradation.

Solvent

extraction utilizes a physical means or a chemical combination of a solvent (often

kerosene) and an extractant to separate out the lithium since the extractant will

select lithium over sodium and magnesium. Solvent extraction can also be used

as a post-DLE step to “polish” the lithium closer to battery quality. The

method has a high recovery rate, and low operating costs, and it eliminates one of

the steps in the other two methods. The downsides of the method are that it is

not applicable to brines with lower lithium concentrations, or those with high

concentrations of magnesium and calcium (which would require preprocessing). The

solvents are also a fire risk with high temperature brines, have corrosion

issues, and environmental transport and disposal issues. It is also an

expensive process.

Membrane

separation utilizes membranes to separate lithium and magnesium ions and may

utilize one of the following to induce the process: pressurized nanofiltration,

electric field(electrodialysis), or thermal gradient. The process is efficient with

low environmental impact but is not applicable to brines with high sodium or

potassium concentrations. It is a water-intensive process that is also

expensive.

An interesting

new membrane separation method involves using 12-Crown-4–functionalized polymer

membranes in coordination with ion binding sites to select for lithium chloride

over sodium chloride. Imbuing the polymers with interactants gives them the

ability to foster the ion transport that separates the lithium out. The sodium

ions bind to the crown ether enough to slow them down so the lithium ions

travel faster through the polymer. The researchers from the University of Texas at Austin

and the University of California, Santa Barbara think that this is a promising

method for extracting from oilfield-produced water. The table below from Goldman Sachs compares

the different brine extraction methods.

The Upper Jurassic Smackover Formation Deep

Sedimentary Basin Lithium Brine Play

Thus far, the

best brine lithium concentrations in the U.S. have been found in the Upper

Jurassic Smackover Formation which is distributed deep in the subsurface along

the Gulf Coast Basin from Eastern Texas to Western Florida. It is a deep

sedimentary basin brine developed in the past as a very productive oil &

gas reservoir in Mississippi, Louisiana, Alabama, and Southern Arkansas. The

brine production comes from zones about 7500-8500ft below the surface in Southern

Arkansas. A company called Standard Lithium has been focusing on lithium extraction

from Smackover brines for a few years now. It is probably one of the best

lithium brines outside of Chile and Argentina, according to Standard Lithium.

Just a few

weeks ago on October 10, 2023, Standard Lithium announced that from a newly

drilled well in East Texas they achieved the highest brine concentration in

North America at 663mg/L which is comparable to the South American brines. Two

samples were taken from the Upper Smackover with the avg. lithium concentration

at 638mg/L. Just a few days ago they reported that a sample from another well

measured lithium at 806mg/L which broke the record from a few weeks ago. The

average overall for their East Texas field is 644mg/L. In addition to lithium,

Standard’s East Texas wells tested at economically viable concentrations of

potassium and bromine as well. Lithium concentrations as high as 597mg/L have

been found in Southwest Arkansas.

The Smackover

formation is limestone, often sucrosic, and locally dolomitized. It overlies

the Norphlet formation and more importantly the Louann Salt formation. The Louann

Salt is the source of the minerals that migrated via faults through the

Norphlet formation into the Smackover. Authors Eva P. Moldovanyi and Lynn M.

Walter in a 1992 AAPG Bulletin article note that their regionally extensive

database of Smackover water geochemistry shows that heterogeneities in

Smackover water geochemistry occur along faults due to upward migration of

hotter fluids. “One of the most pronounced heterogeneities in water

chemistry is an H2S-rich anomaly in the center of the shelf. Enrichments in H2S

are accompanied by large increases in alkali elements (Li, K, and Rb) and B,

which could be produced by higher temperature diagenesis of clay minerals and

feldspars in deeper seated siliciclastic strata.” They also note that bromide

and chloride, concentrated by seawater evaporation, were further enriched by halite

dissolution followed by expulsion of meteoric waters along fault systems.

Looking at Standard Lithium’s Li concentration numbers in Southwest Arkansas on

a map suggests that while Li concentrations vary quite a bit, they could be

contour mapped and compared with structural geology to help determine trends. In

a 2018 thesis, Pamela Joy Daitch utilized the U.S. Geological Survey National

Produced Waters Geochemical Database to identify lithium-rich brine from wells

across the U.S. She found that the Smackover formation was by and far the main

lithium-rich formation brine in the U.S. Based on financial analysis she also determined

that the best way to develop the Smackover was to drill standalone brine wells

where concentrations are the highest. This is how Standard Lithium is

approaching the play. She also noted an economic cutoff concentration for

lithium production of about 70mg/L. This, of course, will vary depending on

lithium prices and extraction innovations. Some of the lithium projects in

Alberta, Canada are at the low end of profitability with concentrations of

about 75mg/L.

The Smackover Bromine Play

The Smackover

formation brine has long been a major source of bromine. Bromine production in

Southern Arkansas began in 1957. According to the Arkansas Dept. of Energy

& Environment: “Since 2007, all US bromine has been produced in southern

Arkansas. In 2013, 28% of the global bromine production (225,000 tonnes) in

Arkansas made the United States the second-largest producer of bromine, after

Israel. At an advertised price of US$3.50 to US$3.90 per kg, the 2013 Arkansas

production would have a value of roughly US$800 million.” Fire retardants

are the major use of Arkansas bromines, making up about half of the production.

Other uses include insect and fungus sprays, anti-knock compounds for leaded

gasoline, disinfectants, photographic preparations and chemicals, solvents,

water-treatment compounds, dyes, insulating foam, hair-care products, pharmaceuticals,

energy storage, mercury emissions reduction, reinforcing rubber materials, and

oil well-drilling fluids. Bromine is a highly corrosive liquid. It is harmful

if it contacts human skin and breathing its vapors is harmful, so safety precautions

are in place at processing plants. Albemarle Corporation and Chemtura are the

two biggest bromine producers in South Arkansas.

The Salton Sea Geothermal Brines Lithium Play in

Southern California

In

California, the geothermal brines below the evaporating Salton Sea are a great

source of lithium and other minerals. The hot brines are already being

circulated to the surface in geothermal wells to power the steam turbines of

the geothermal plants. Brine production rates are high in the Salton Sea. The high

flow rates associated with the geothermal wells mean processing rates have to

be high to keep up. This is challenging. Many DLE projects are ramping up in

the Salton Sea play. Investors include Energy ventures by Bill Gates and Jeff

Bezos, Warren Buffet’s Berkshire Hathaway, the U.S. DOE, and automaker

Stellantis. The biggest players in the Salton Sea DLE Projects are Berkshire Hathaway

Energy, EnergySource Minerals, and Controlled Thermal Resources (CTR).

The Salton Sea

is one focus for the U.S. ramp-up of domestic critical minerals production,

deemed as necessary to reduce dependence on China and to eventually ease supply

chain issues. Typically, geothermal energy powers mineral extraction, keeping

emissions low. Some CO2 is released in the steam that surfaces in the course of

geothermal energy production.

As of 2022, there were 11 geothermal power plants in the Salton Sea area, also now known as

Lithium Valley. As mentioned, the flow rates from the geothermal recycling

process are very high so the extraction methods need to be scaled up for the

higher flow rates. While the Smackover play has a much higher lithium concentration

than the Salton Sea, it may have a lower brine production rate. I am just

speculating here. The Salton Sea has the advantage that the extraction of the metals is a co-benefit to the geothermal power plants so that operation is simultaneous.

It is unlikely that existing Smackover oil and gas wells will develop mineral extraction as a co-benefit, especially since standalone brine wells have been

the preferred method for bromine recovery for many years. Berkeley Lab has been

leading the effort to quantify the Salton Sea geothermal brine resources.

Flow rates may

also affect the depletion of the brine of the desired minerals. Productivity of

wells, flow rates and recirculation rates, and geochemistry of the brine are

some of the main variables that can affect depletion. The paper about the environmental impacts of DLE from brines emphasized the importance of geochemical

heterogeneity as follows: “Knowledge of the precise number, distribution and

depths of brine and fresh water wells is vital for hydrogeological modeling of

lithium brine deposits. The distinct hydrogeology of each salar means that each

deposit should be modelled independently, and results from one exploitation

cannot be directly extrapolated to another.” This suggests that there should

be more data collected as brine samples at different depths in many more wells

to map out mineral concentrations in each zone. This data should be compared to

geology trends like faults and stratigraphy.

Brine Mining from Marcellus Shale Produced Water in

Pennsylvania

Brine mining

projects in the Marcellus Formation in Pennsylvania tap a brine with a lithium

concentration of 95mg/L on average but also leverage pre-existing oilfield

water treatment facilities where direct mineral extraction provides additional

revenue. According to Shale Directories: “Eureka Resources owns and operates

three centralized treatment/recycling facilities that process flowback/produced

waters (i.e. wastewater) from the Marcellus Shale. Two of the facilities are

located in Williamsport (Lycoming County), PA, and one in Standing Stone

Township (Bradford County), PA, near Towanda. Eureka has just announced a joint

venture to use high tech to recover lithium from the Marcellus wastewater they

process.” The lithium recovery venture was announced together with Canada’s

MGX Minerals in March 2019. The Eureka process treats about 10,000 Bbls

(420,000 gals) per day of brine to extract sodium chloride, calcium chloride, freshwater,

and lithium. MQX Minerals uses its own DLE method to extract lithium.

Together the two companies plan to install multiple lithium rapid recovery

systems at wastewater treatment facilities across the Marcellus and Utica shale

formations. Utica brine has a lower average lithium, around 70mg/L which is near

the cutoff of economic feasibility. This effort opened the gates to petrolithium, the extraction of lithium from oilfield brines. They say they can process oilfield

brines rapidly and at smaller scales as well.

In November

2020 Eureka Resources got a patent for their own lithium extraction technology

and expanded their Northeast Pennsylvania operations. Eureka reported in late

July 2023 that they successfully produced 97% pure lithium carbonate from the

Marcellus brine, in partnership with SEP Salt & Evaporation Plants Ltd.

(SEP). Apparently, they are utilizing the same methods to extract lithium as they

use to extract sodium chloride and calcium chloride. They say it will be

operational within two years, by mid-2025, which would make it the fastest-to-market lithium brine extraction technology, including DLE (it is apparently not

a DLE method as normally understood). The brine is pretreated to remove heavy

metals, ammonia, magnesium, sulfates, carbonates, and TOC through filtration, pH

adjustment and precipitation reactions. SEP employs several proprietary

extraction and recrystallization processes.

Oilfield Brines Processing. Source SEP

Paradox Basin Brine Mining Play in Utah and Colorado:

Lithium, Potash, Bromine, and Boron

The Paradox Basin is a Pennsylvanian-aged sedimentary

basin with a thick sequence of evaporites and brines that yield favorable concentrations

of minerals. It is thought to be one of the largest potential sources of potash

in America. The brines also contain commercial concentrations of lithium,

bromine, boron, and likely iodine. The depths of the brines in the Southern Natural

Gas well log and stratigraphic column (shown below) range from 5000ft to 7500ft below the surface. American Potash Corporation is exploring for brine minerals in the

Paradox Basin and expects to employ both solar evaporation ponds and direct

extraction.

Anson

Resources plans to extract lithium and bromine from Paradox Basin brines in

Utah. According to Mining Weekly: “The proposed Phase 2 expansion will

target substantial expansion in the production of lithium carbonate and

bromine, and will expand the Paradox project resources through the re-entry and

sampling of historic wells, including Mineral Canyon; Sunburst; and high-grade,

large Mississippian formations.” Thus, they plan to get more concentration

data, including for deeper Mississippian formations.

Brine Processing Plants Processing Oilfield Brines and

Desalinization Plant Effluent for Minerals Extraction, Irrigation, and Drinking

Water

A Brine processing

plant plans to extract minerals from oilfield brine and brackish brine from the

adjacent desalinization plant. This is not happening anywhere yet but a project

in El Paso, Texas, that previously failed to materialize due to financial,

investor, and engineering difficulties was purchased by a Florida company,

Critical Minerals Corporation that plans to reconfigure and run the plant. The desalinization

plant, the largest inland one in the U.S., has been in operation since 2007.

The plan is to treat the brine and extract minerals to sell to oil & gas

companies and for fertilizer. Lithium extraction is also in the works when more

lithium-rich brines can be delivered. The brine processing plant will be the first

of its kind in the country. I am not sure about the timeline or what stage of

commercialization is happening at present.

Japanese Iodine-Rich Brine and Natural Gas Play

Chile produces more

than half of the world’s iodine and Japan about 30%. Together the two countries

produce nearly 90% of the global supply. Chile’s production comes from naturally

concentrated precipitates. Japan produces iodine along with natural gas from

brines. Natural gas is dissolved in the brines in Chiba prefecture and other

areas. According to the book Iodine Chemistry and Applications: “Iodine

production in Japan occurs at the Minami-Kanto gas field near Tokyo, the

Niigata gas field, the Nakajo oil and gas field, both in Niigata Prefecture,

and the Sadowara gas field in Miyazaki Prefecture, all of which are

brine-dissolved gas fields. Although iodine is known to exist at high

concentrations in submarine sediments, the commercial production of iodine from

brine involves drilling on land. In Japan, iodine is produced from natural gas

brine by a blowing-out process and an ion-exchange process.” After

extraction, the water must be reinjected back into the ground to prevent land subsidence

due to the presence of unconsolidated sediments. This prevents the operations

from expanding processing volumes. Below is a schematic of the blowout process

for extracting iodine.

Iodine Brine Play in Pennsylvanian Morrow Sandstone in

the Anadarko Basin in Northwest Oklahoma

The U.S. is the world’s

third-largest iodine producer. The iodine in the U.S. comes from the Late Pennsylvanian-aged Morrow Sandstone in the Anadarko Basin of Northwest Oklahoma. AAPG’s Susan

Nash writes “Chile is the world’s dominant producer, where iodine is

recovered principally by heap-leaching nitrates containing iodate. In Japan’s

Chiba prefecture, iodine is recovered from natural gas brines using the blowing

out process, which involves vaporizing the iodine, then absorbed, crystallized,

and purified. In Oklahoma, the iodine is found in the Morrow sand brines. It is

also extracted via proprietary processes from the oilfield brines co-produced

with oil and gas. There are currently three operators in Oklahoma, along with

another chemical company that creates products from the brine.” The iodine-rich

brine is produced from a single paleo-valley located in the Anadarko Basin in

one specific feature, the Woodward Trench, a paleo-valley 1 to 2 miles wide in

the Morrow formation that extends 70 miles from Vici, Oklahoma, north to the

Kansas border. The source of the iodine is the Late Devonian/Early

Mississippian Woodford Shale which lies below the Morrow. Organic matter

including seaweed, brown algae, coral, and other marine life helped to

concentrate the iodine in the shale. The iodine concentration in the Mississippian

rocks of the Woodward Shale is as high as 1560 parts per million (ppm). The iodine-rich

brines occur at depths from 6000 ft to 10,000 ft below the surface. The iodine

concentration in the Morrow Sandstone is as high as 700 ppm. This is about twice as concentrated as the

Japanese brines which have average concentrations of about 160 mg/L. This maximum

concentration (700 ppm) is at least three times higher than anywhere else found

in the U.S. with the exception of newly found iodine-rich brines in the Paradox

Basin with concentrations as high as 596mg/L, almost twice that of the Morrow Sand. Nash wonders whether there are

any other paleo valleys in the Anadarko vicinity or elsewhere with iodine-rich

brine that await discovery.

The first iodine

processing plant was built in Oklahoma in 1977, based on Japanese and European

designs. Acids are used in iodine processing, which requires precautions for

handling corrosive material. Iodine prices rose sharply in 2017-2023 by 200%. Uses

for iodine include X-ray contrast (biggest use), disinfectants, liquid crystal

displays (LCDs), nutritional supplements for humans and animals, pharmaceuticals,

LEDs, and specialty chemicals. Iodine recovery from oilfield brines involves

settling tanks where the oil is skimmed off the top and chlorination of the

brine which separates out the iodine. The vaporized iodine compounds are

condensed back into a liquid or solid form through distillation or sublimation and

further purified by extraction through oxidation-reduction reactions. The

process yields flakes or pellets of 98% pure iodine.

This map does not have the 596mg/L data point in Southeast Utah Paradox Basin

Leduc Lithium Brine Play in Western Canada

E3 Lithium

reported in mid-October 2023 that they recently tested their DLE pilot project

in Alberta’s Leduc Brines. The tests evaluated lithium recovery and lithium

grade at different flow rates. The company noted that all the parameters

exceeded their expectations. Thus, they are optimistic about continuing toward

commercialization. The Leduc brines are at the lower end of lithium concentrations

for economic viability so I would guess projects in that range would be

especially sensitive to lithium prices and things like O&M costs.

Calgary, Alberta-based Volt Lithium has a pilot demo project at Rainbow Lake in northwest Alberta. They are processing oilfield brines from throughout North America. Lithium hydroxide and lithium carbonate are produced. The pilot was a success. They are now building a permanent demonstration plant. A schematic is shown below.

Extraction of Rare Earth Elements from Brines: Currently,

Not Economically Feasible

A 2017 paper On

the Extraction of Rare Earth Elements from Geothermal Brines. York R. Smith,

Pankaj Kumar, and John D. McLennan. Resources 2017, 6(3), 39, concluded

that “rare earth element extraction from geothermal fluids is technically

possible, but neither economically viable nor strategically significant at this

time.” Rare earths can far better be extracted from veins of much higher

concentration than brines. Basically, the same separation methods used for

critical minerals would be used to separate rare earth elements in brines, if

and when doing so ever becomes feasible.

Market Predictions and Incentives

Most economic

scenarios that incorporate the energy transition forecast continued increases

in demand for lithium and some of the other brine minerals. DLE as a

processing method is very desirable due to its low environmental, climate, and

land footprints. It is already modeled as cost-comparable to solar evaporation.

Thus, it seems likely that widespread adoption is likely in the next 5-10

years. The number of pilot and commercialization projects in development and

planning has been growing. Over the next 2-5 years we should get an idea of what

DLE can do to meet demand and for the U.S. perhaps ensure a more robust domestic

supply with clean energy credentials.

In the U.S.

the Critical Minerals Exploration Tax Credit (CMETC) was expanded from 15% to

30% as part of the Inflation Reduction Act. This credit includes lithium and a

few other brine minerals like zinc and magnesium. It will offset some of the

inflation and help companies commercialize their projects and operations.

References:

Brine

Mining. Wikipedia. Brine mining - Wikipedia

Bittern. Wikipedia. Bittern (salt) - Wikipedia

Standard

Lithium’s East Texas Drilling Program Delivers New Highest Confirmed Grade

Lithium Brine in North America. Standard Lithium. Press Release. October 10,

2023. Standard Lithium’s East Texas

Drilling Program Delivers New Highest Confirmed Grade Lithium Brine in North

America :: Standard Lithium Ltd. (SLI)

E3

Lithium Says Field Pilot Test Results Exceed Expectations. Hart Energy. October

18, 2023. E3 Lithium Says Field Pilot Test

Results Exceed Expectations | Hart Energy

An

Overview of Commercial Lithium Production. Terence Bell. ThoughtCo. August 21,

2020. Commercial Lithium Production and

Mining of Lithium (thoughtco.com)

New

methods could extract large lithium stores from brine. Jay Landers, Civil

Engineering Magazine. October 26, 2023. New methods could extract large

lithium stores from brine | ASCE

Standard

Lithium Delivers Highest-Ever North American Lithium Brine Grade 806 mg/L; East

Texas Asset Includes Significant Potash and Bromine Concentrations. Standard

Lithium. October 25, 2023. Standard Lithium Delivers

Highest-Ever North American Lithium Brine Grade 806 mg/L; East Texas Asset

Includes Significant Potash and Bromine Concentrations :: Standard Lithium Ltd.

(SLI)

Petrolithium:

Extracting Minerals From Petroleum Brine. Jared Lazerson, MGX Minerals. Hart

Energy. April 3, 2017. Petrolithium: Extracting Minerals

From Petroleum Brine | Hart Energy

Environmental

impact of direct lithium extraction from brines. María L. Vera, Walter R.

Torres, Claudia I. Galli, Alexandre Chagnes & Victoria Flexer. Nature

Reviews Earth & Environment volume 4, pages149–165 (2023). February 23,

2023. Environmental impact of direct

lithium extraction from brines | Nature Reviews Earth & Environment

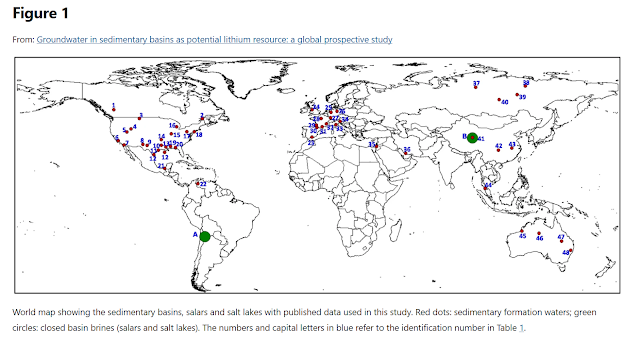

Groundwater

in sedimentary basins as potential lithium resource: a global prospective study.

Elza J. M. Dugamin, Antonin Richard, Michel Cathelineau, Marie-Christine

Boiron, Frank Despinois & Anne Brisset. Scientific Reports volume 11,

Article number: 21091 (2021). October 26, 2021. Groundwater in sedimentary basins as

potential lithium resource: a global prospective study | Scientific Reports

(nature.com)

Prospects

of metal recovery from wastewater and brine. Ryan M. DuChanois, Nathanial J.

Cooper, Boreum Lee, Sohum K. Patel, Lauren Mazurowski, Thomas E. Graedel &

Menachem Elimelech. Nature Water volume 1, pages37–46 (2023). January 19, 2023.

Prospects of metal recovery from

wastewater and brine | Nature Water

Regional

Trends in Water Chemistry, Smackover Formation, Southwest Arkansas: Geochemical

and Physical Controls. Eva P. Moldovanyi and Lynn M. Walter. AAPG Bulletin

(1992) 76 (6): 864–894. Regional

Trends in Water Chemistry, Smackover Formation, Southwest Arkansas: Geochemical

and Physical Controls1 | AAPG Bulletin | GeoScienceWorld

Lithium

extraction from oilfield brine. Pamela Joy Daitch. Thesis Abstract, June 19,

2018. University of Texas at Austin. Lithium extraction

from oilfield brine (utexas.edu)

As

Companies Eye Massive Lithium Deposits in California’s Salton Sea, Locals

Anticipate a Mixed Bag. June Kim. Inside climate News. August 26, 2023. As

Companies Eye Massive Lithium Deposits in California’s Salton Sea, Locals

Anticipate a Mixed Bag - Inside Climate News

Lithium

recovery from shale gas produced water using solvent extraction. Eunyoung Jang, Yunjai Jang, Eunhyea

Chung. Applied Geochemistry. Volume 78, March 2017, Pages 343-350. Lithium

recovery from shale gas produced water using solvent extraction - ScienceDirect

Eureka

To Extract Lithium From Marcellus/Utica Wastewater. Shale Directories. March

2019. Eureka

to Extract Lithium from Marcellus/Utica Wastewater - Shale Directories

MGX

Minerals and Eureka Resources Announce Joint Venture to Recover Lithium from

Produced Water in Eastern United States. MGX Minerals. March 5, 2023. MGX

Minerals and Eureka Resources Announce Joint Venture to Recover Lithium from

Produced Water in Eastern United States (prnewswire.com)

Lithium

recovery from brine: Recent developments and challenges. Abdullah Khalil,

Shabin Mohammed, Raed Hashaikeh, Nidal Hilal. Desalination. Volume 528, 15

April 2022, 115611. Lithium

recovery from brine: Recent developments and challenges - ScienceDirect

Florida

firm plans to mine minerals by reviving failed El Paso brine treatment plant. Vic

Kolenc. El Paso Times. April 21, 2021. Florida

firm plans to mine brine waste by reviving El Paso plant (elpasotimes.com)

Technology

for the Recovery of Lithium from Geothermal Brines. William T. Stringfellow and

Patrick F. Dobson. Energies 2021, 14(20), 6805. October 18, 2021. Energies | Free Full-Text |

Technology for the Recovery of Lithium from Geothermal Brines (mdpi.com)

Geothermal

brines in California’s Salton Sea could be future source of lithium in the US. Valentina

Ruiz Leotaud. Mining.Com. December 12, 2021. Geothermal

brines in California’s Salton Sea could be future source of lithium in the US -

MINING.COM

Paradox

basin brine project. US. Creamer Media’s Mining Weekly. May 12, 2023. Paradox

basin brine project. US (miningweekly.com)

Lithium

& Brine Project: Paradox Basin, Utah. American Potash Corporation. Presentation.

September 2022. paradox_basin_lithium_and_brine_project_sept_2022.pdf

(americanpotash.com)

General

Information Regarding Brine in Arkansas and Geology of Brine Resources in South

Arkansas. Arkansas Dept. of Energy & Environment. Office of the State

Geologist. Brine

(Bromine) in Arkansas

Brine

Mining Iodine in Oklahoma: A Little-Known Treasure. Susan Nash, Director of

Innovation & Emerging Science and Technology / AAPG. June 11, 2023. (24)

Brine Mining Iodine in Oklahoma: A Little-Known Treasure | LinkedIn

Direct

Lithium Extraction: A potential game-changing technology. Goldman Sachs. April

27, 2023. Global

Metals & Mining Direct Lithium Extraction A potential game changing

technology (goldmansachs.com)

Iodine.

U.S. EPA. Identification

and Description of Mineral Processing Sectors and Waste Streams | US EPA

ARCHIVE DOCUMENT

Iodine.

Stanley T. Krukowski. Oklahoma Geological Survey. Mining Engineering. July 2016.

MEV68.7P54-57-Krukowski-Iodine.pdf

(ou.edu)

Engineering

Li/Na selectivity in 12-Crown-4–functionalized polymer membranes. Samuel J.

Warnock, Rahul Sujanani, Everett S. Zofchak, and Christopher M. Bates. PNAS.

September 7, 2021 118(37).

Engineering Li/Na

selectivity in 12-Crown-4–functionalized polymer membranes | PNAS

How

lithium can be efficiently extracted from oil and gas wastewater. Mining.Com.

Staff Writer | September 22, 2021. How

lithium can be efficiently extracted from oil and gas wastewater - MINING.COM

On the

Extraction of Rare Earth Elements from Geothermal Brines. York R. Smith, Pankaj

Kumar, and John D. McLennan. Resources 2017, 6(3), 39. Resources | Free Full-Text |

On the Extraction of Rare Earth Elements from Geothermal Brines (mdpi.com)

Eureka

Resources expanding operations in northeast Pennsylvania. NCPA Staff Mar 29,

2021. North Central PA. Eureka

Resources expanding operations in northeast Pennsylvania | Business |

northcentralpa.com

Eureka

Resources Successfully Produces Lithium Carbonate From Oil & Natural Gas

Brine Wastewater. July 31, 2023. Business Wire. Eureka

Resources Successfully Produces Lithium Carbonate From Oil & Natural Gas

Brine Wastewater | Business Wire

Shale

Gas Produced Water. SEP. Shale

Gas Produced Water (sepwin.ch)

Lithium

Salts. SEP. Lithium

Salts (sepwin.ch)

Paradox

basin brine project. US. Sheila Barradas. Creamer Media’s Mining Weekly. May

12. 2023. Paradox

basin brine project. US (miningweekly.com)

Utica

Shale Play Oil and Gas Brines: Geochemistry and Factors Influencing Wastewater

Management. Madalyn S. Blondes, Jenna L. Shelton, Mark A. Engle, Jason P.

Trembly, Colin A. Doolan, Aaron M. Jubb, Jessica C. Chenault, Elisabeth L.

Rowan, Ralph J. Haefner, and Brian E. Mailot. Environ. Sci. Technol. 2020, 54,

21, 13917–13925. October 14, 2020. Utica Shale Play Oil

and Gas Brines: Geochemistry and Factors Influencing Wastewater Management |

Environmental Science & Technology (acs.org)

Berkeley

Lab leading investigation to quantify and characterize Salton Sea’s geothermal

lithium resources. Green Car Congress. February 17, 2022. Berkeley

Lab leading investigation to quantify and characterize Salton Sea’s geothermal

lithium resources - Green Car Congress

Iodine

and Natural Gas. Nippoh Chemicals. Iodine and Natural Gas

| Unique Technologies | NIPPOH CHEMICALS (npckk.co.jp)

Iodine

Chemistry and Applications, Editor: Tatsuo Kaiho, Wiley, October 2014. Chapter

13: Iodine Production from Natural Gas Brine. Iodine

Production from Natural Gas Brine - Iodine Chemistry and Applications - Wiley

Online Library

No comments:

Post a Comment