The Statistical Review of World Energy was formerly published by BP and is now published by KPMG and the Energy Institute. The host web page for the report offers five insights from the 2023 report: 1) post-Covid transport fuel demand has mostly returned but is now distributed differently. 2) record high oil, natural gas, and gasoline prices were due to the Ukraine war in 2022 which resulted in unprecedented shifts in global delivery flows of oil and gas. 3) record wind and solar deployment accounted for 84% of net electricity growth. 4) global primary energy grew by 1% with fossil fuels basically unchanged at 82% of the total. 5) global energy-related emissions grew at 0.8% as growth in high-emissions fuels eclipsed strong renewables growth.

Now, late in

3Q 2023, natural gas prices are down to manageable levels. Natural gas storage

fields in Europe are filled at sufficient levels. Oil prices are being levered

by OPEC+, a bit too much for my taste.

Wind and solar deployment are set to continue but there

are issues, including wind companies losing money for different reasons. Supply

chain issues, wind component manufacturing issues, public opposition to projects,

higher costs of the U.S. domestic content requirement, transmission bottlenecks

and grid integration challenges, and permitting and regulatory issues are among

the reasons wind and solar deployment won’t accelerate much faster anytime

soon. The fact that wind and solar covered 84% of net electricity growth, while

quite a lot of deployment, also means that 16% of that growth was likely covered

by fossil fuels, which hardly gives support for those saying we should

eliminate fossil fuels, as does their holding at 82% of primary energy consumption.

I mean, it’s not yet even covering demand growth, let alone replacing fossil

fuels. Loss of nuclear and coal power also has to be covered.

The 2022 growth

in emissions was likely partially related to reactions to the Russian invasion

of Ukraine as countries scrambled to replace Russian pipeline gas with

resources like high-emissions lignite coal in Germany, Poland, and other

countries. Pipeline gas has lower emissions than LNG so the replacement of it

by LNG also led to higher emissions. High natural gas prices in Asia no doubt

led to more burning of coal. That even occurred in the U.S. as plants that are

able always burn more coal when natural gas prices are high. 2022 also saw

record high lithium prices which have since come down to more reasonable

levels.

Suppressed

demand in 2020 and 2021 due to Covid makes it hard to evaluate some of the data

from 2022 since increases in demand and emissions can also be attributed to the recovery of economic activity. Thus, some of the year-over-year changes can be

less meaningful to interpreting overall trends.

Primary energy

consumption continued to increase overall, hitting 600 exajoules for the first time.

The Asia

Pacific region, which includes China and India, continues to increase its

share of primary energy consumption, now approaching 50%, while the share from

North America and Europe continues to decline as a result. This simply reflects

more development needs in the Asia Pacific region, and this trend is expected

to continue.

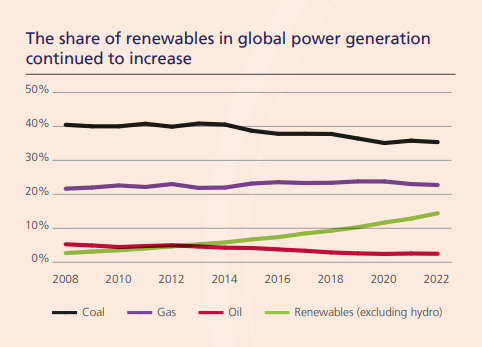

The global

share of wind and solar in global power production continued to rise, reaching 14%.

Coal still leads at 35%, followed by natural gas at 23%. If much of the remaining

coal is to be replaced, much of it will likely be replaced by natural gas as

well as renewables.

In 2022, 18%

of crude oil, 19% of natural gas, and 14% of coal were still bought from

Russia. I would expect those numbers to drop in 2023. However, it has been

reported that Russian LNG sales to Europe have actually risen this year even as

pipeline sales have dropped. Oil, gas, coal, fertilizer, and minerals are key

funders of the Russian economy as well as the Russian war effort against Ukraine.

The data is

given in the report and can be easily graphed to reveal much about energy use

and emissions. I made the following graphs from the data. The first two show several

interesting things. One is that while China and the U.S. dominate primary energy

consumption, China alone dominates CO2 emissions. They show India’s higher CO2

emissions intensity than the U.S. They show the lower CO2 emissions intensity

of especially France, but also of Russia due to nuclear. They show the higher CO2

intensity of Indonesia due to coal and of Japan due to less use of nuclear. They

show the lower CO2 intensity of Canada and Brazil due to hydro.

Natural gas

flaring rates have been dropping in recent years and in most countries dropped

in 2022. The overall data was a bit surprising to me. The graph below shows

that 4 countries: Russia, Iran, Iraq, and Venezuela account for just about half

of global natural gas flaring. The U.S. accounts for just 6% of natural gas

flaring while being the world’s largest producer of crude oil and condensate (14.6%

of global production). See the graph below.

Another

interesting observation is that the U.S. dominates global natural gas liquids

production by a wide margin, producing nearly half of the world’s NGLs and

nearly 4 times that of its nearest competitor, Saudi Arabia.

Installed wind

and solar are dominated by China with the U.S. at a distant second. Germany,

India, and Japan (only on solar) are distant thirds.

The Statistical

Review of World Energy remains a vital and useful resource to evaluate world and

regional energy and electricity production and consumption as well as emissions

associated with energy production and consumption. It gives us an idea of who

is doing what, global trends, and regional trends.

References:

Statistical Review of World Energy. June

2023. Home |

Statistical Review of World Energy (energyinst.org)

No comments:

Post a Comment