Coal-to-oil by direct liquefaction is a process that bypasses gasification, which is a normal step in indirect coal liquefaction. The DOE’s NETL describes the process of direct coal liquefaction and compares it to indirect coal liquefaction as follows:

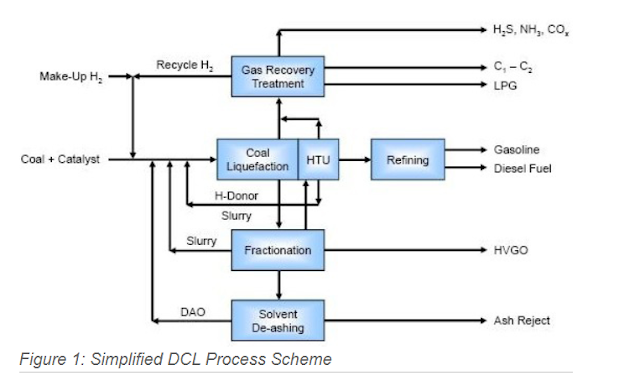

“Direct coal liquefaction involves contacting coal

directly with a catalyst {often cobalt iron-based} at elevated temperatures and

pressures with added hydrogen (H2), in the presence of a solvent to form a raw

liquid product which is further refined into product liquid fuels. DCL is

termed direct because the coal is transformed into liquid without first being

gasified to form syngas (which can then in turn be transformed into liquid

products). The latter two-step approach, i.e. the coal to syngas to liquids route

is termed indirect coal liquefaction (ICL). Therefore, the DCL process is, in

principle, the simpler and more efficient of the two processes. It does,

however, require an external source of H2, which may have to be provided by

gasifying additional coal feed, biomass and/or the heavy residue produced from

the DCL reactor. The DCL process results in a relatively wide hydrocarbon

product range consisting of a variety of molecular weights and forms, with

aromatics dominating. Accordingly, the product requires substantial upgrading

to yield acceptable transportation fuels.”

The world’s largest single

coal-to-liquids (CTL) project is located in the Ningdong Energy and Chemical

Industry Base, 40 km away from Yinchuan, the provincial capital of the Ningxia

Hui Autonomous Region, in the western part of China. Construction began in

2013, and it was commissioned in 2016. To convert 1 ton of oil, it consumes 3.5

tons of coal and 6.1 tons of water. China has a high demand for oil but a low

supply. They do, however, have a high supply of coal. Thus, the country has

long developed CTL technology. Liquifying coal results in double the CO

emissions relative to burning oil. It is, however, more readily captured.

According to Wikipedia, this project currently makes 4 million tons/year of

diesel & naphtha. The tables below show all the CTL projects in the world,

non-U.S. and U.S. Most of the U.S. projects have been cancelled as

uneconomical. The U.S. likely would be developing those projects if it hadn’t

been for the discovery and production of significant shale gas and oil reserves

over the past few decades.

The DCL technology DOE helped

to develop with Hydrocarbon Technologies, Inc., HTI (now part of Headwater,

Inc.), was licensed to Shenhua Corporation of China in 2002, which built a DCL

plant in Erdos, Inner Mongolia based on Headwaters technology. That first DCL

plant began operations in 2008. According to NETL:

“The DCL process involves adding hydrogen

(hydrogenation) to the coal, breaking down its organic structure into soluble

products. The reaction is carried out at elevated temperature and pressure

(e.g., 750 to 850°F and 1,000 to 2,500 psia) in the presence of a solvent. The

solvent is used to facilitate coal extraction and the addition of hydrogen. The

solubilized products, consisting mainly of aromatic compounds, then may be

upgraded by conventional petroleum refining techniques such as hydrotreating to

meet final liquid product specifications.”

China’s CTL capacity rose 24%

to 11 million tons in 2023 compared to 2019. A planned 4 million ton per day

CTL project expected to cost $24 billion is being developed by China Energy

Investment Corporation, formerly Shenhua, and is expected to begin operations

in 2027. This will be built in the Xinjiang region, which is rich in coal but

remote and far away from consumers. This would make up more than a quarter of

China’s current CTL capacity, but other CTL projects are in the works as well.

According to Global Times, the project is expected to produce 4 million tons of

CTL products annually, including 3.2 million tons from direct liquefaction and

800,000 tons from indirect liquefaction.

“The project combines coal mining, coal-to-oil

conversion, coal chemicals, renewable energy, and new materials production. It

features the world's first second-generation CTL technology and is the first

coal-to-oil project in Xinjiang.”

"The project taps into Hami's coal and renewable

energy resources to build a national coal-to-oil and gas strategic base,

boosting efficient coal use and strengthening Xinjiang region's role in China's

energy security," Lin Boqiang, director of the China Center for Energy

Economics Research at Xiamen University, told the Global Times on Wednesday.

It is uncertain whether

carbon capture will be a feature, but that seems a likely possibility as the

state-owned company operates CCS projects.

References:

China

Energy Investment readies $24bn for coal-to-oil project. Ed Pearsey. Offshore

Technology. October 10, 2024. China Energy Investment readies $24bn

for coal-to-oil project - Offshore Technology (offshore-technology.com)

Coal

liquefaction. Wikipedia. Coal liquefaction - Wikipedia

Direct

Liquefaction Processes. DOE. National Energy Technology Lab (NETL). 10.6. Direct Liquefaction Processes |

netl.doe.gov

Coal

Gasification and Liquefaction. Civils360. February 9, 2022. Coal Gasification and Liquefaction -

Explained | UPSC | Civils360 IAS

Visiting

the world’s biggest single coal-to-liquid project in Yinchuan, China. Xing

Zhang. June 27, 2017. IEA. Sustainable Carbon. Visiting

the world's biggest single coal-to-liquid project in Yinchuan, China - ICSC

China

Energy to invest $24 billion in coal-to-liquid project. October 10, 2024.

DieselNet. news: China

Energy to invest $24 billion in coal-to-liquid project

CHN

Energy Investment Group launches 170 billion yuan project in Xinjiang's Hami. Zhang

Yiyi. Global Times. October 9, 2024. CHN Energy

Investment Group launches 170 billion yuan project in Xinjiang's Hami - Global

Times

No comments:

Post a Comment